Advanced Driver Assistance System Market Research Report: By Solution Type (Adaptive Cruise Control (ACC), Blind Spot Detection System (BSD), Park Assistance, Lane Departure Warning (LDWS) System, Tire Pressure Monitoring System (TPMS), Autonomous Emergency Braking (AEB), Adaptive Front Lights (AFL), Others), By Component Type (Processor, Sensors, Software, Others), By Vehicle Type (Passenger Car, Commercial Vehicle), and Region (North America, Europe, Asia-Pacific, and Rest of the World) Global Industry Analysis, Size, Share, Growth, Trends, Regional Analysis, Competitor Analysis and Forecast 2024-2032.

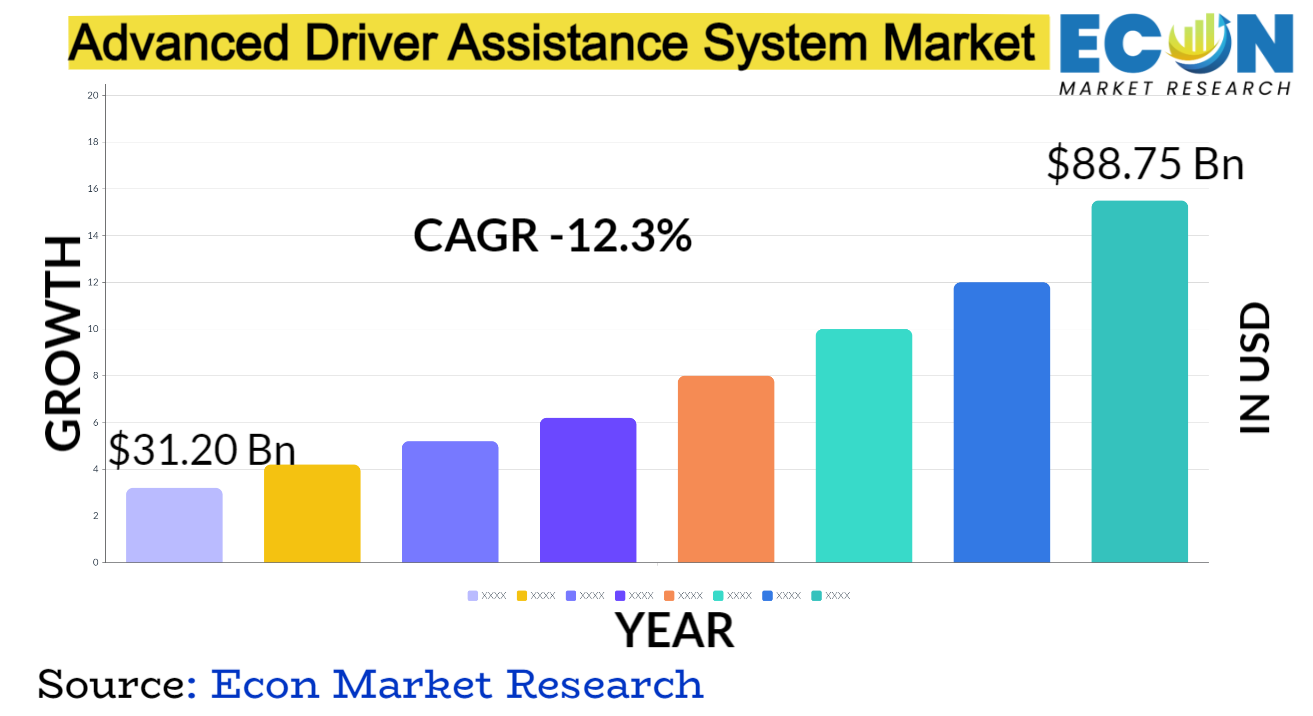

The Advanced Driver Assistance System Market was valued at USD 31.20 billion in 2023 and is estimated to reach approximately USD 88.75 billion by 2032, at a CAGR of 12.3% from 2024 to 2032.

Since its launch, the market for advanced driver assistance systems (ADAS) has grown quickly. ADAS was first designed to improve car safety, but it has since developed into a complex set of tools meant to help drivers and reduce collisions. The early ADAS systems were largely equipped with features like automatic emergency braking, adaptive cruise control, and lane departure wa ing. They were introduced in response to growing conce s about road safety. More sophisticated functions, such blind-spot monitoring, semi-autonomous driving, and pedestrian identification, were added as a result of technical breakthroughs over time.

The convergence of cutting-edge sensors, AI-driven algorithms, and networking technologies inside vehicles has been the main driver of this evolution. The market has drawn large investments from software firms, automakers, and startups, creating a competitive environment with the goal of improving driving comfort, safety, and overall experience. ADAS systems have the potential to completely change how we view and interact with cars as they develop and show their worth. They will soon be a regular feature in current cars.

ADVANCED DRIVER ASSISTANCE SYSTEM MARKET: REPORT SCOPE &, SEGMENTATION

| Report Attribute | Details |

| Estimated Market Value (2023) | 31.20 Bn |

| Projected Market Value (2032) | 88.75 Bn |

| Base Year | 2023 |

| Forecast Years | 2024 - 2032 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Solution Type, By Component Type, By Vehicle Type, &, Region |

| Segments Covered | By Solution Type, By Component Type, By Vehicle Type, &, Region |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2024 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa, and the Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Advanced Driver Assistance System Market Dynamics

The world is constantly changing due to technological breakthroughs, with connectivity, AI algorithms, and sensor downsizing playing key roles. Global legislative requirements that force automakers to incorporate safety features like automated emergency braking and lane-keeping assistance also impact market dynamics. Furthermore, the industry is driven ahead by consumer desire for increased safety, comfort, and convenience, which encourages the development of more advanced ADAS functions. Working together, suppliers, IT firms, and automakers promotes innovation and speeds up the ADAS industry',s development.

The move toward autonomous driving, with ADAS serving as a stepping stone, is driving market dynamics even more. The need for complete ADAS suites increases as cars become more automated and networked. As businesses compete to offer cutting-edge features, competition heats up and ADAS accessibility in mainstream cars improves and costs are reduced. Because of the dynamic nature of this market, it is necessary to maintain a careful balance between technological innovation, consumer preferences, regulatory compliance, and industry collaboration. These factors all contribute to the ongoing advancement and widespread use of ADAS in the automobile sector.

Advanced Driver Assistance System Market Drivers

- Technological Advancements

These drivers cover a wide range of advances, from improved sensors to complex AI algorithms and connectivity fixes. Crucial parts of ADAS, sensors, have experienced substantial improvement, becoming more accurate, effective, and economical. When multiple sensors, including cameras, radars, LiDAR, and ultrasonic sensors, come together, they form a vast data collection network that allows the system to see its environment remarkably well.

Furthermore, ADAS capabilities have been completely transformed by AI and machine lea ing algorithms. These clever algorithms interpret the vast amounts of data gathered by sensors, quickly deciphering intricate traffic situations and facilitating in-the-moment decision-making. This development improves overall safety by enabling ADAS to anticipate and react to possible hazards in addition to detecting impediments. Connectivity technologies enable communication between vehicles and infrastructure (V2I and V2V), which further enhances ADAS capabilities. Because of this connectedness, information may be shared between cars and infrastructure components, enhancing decision-making and offering a more comprehensive view of the exte al world.

- Rise in Autonomous Driving Development

It acts as an ADAS technology source as well as a catalyst. In order to achieve complete autonomy, the development of autonomous cars demands the incorporation of ADAS features that are progressively more sophisticated. This driver pushes the limits of current ADAS capabilities by increasing the demand for more complex systems that can handle a variety of driving scenarios. Research and innovation in sensor technology, artificial intelligence, and processing power are accelerated by the development of autonomous driving. These developments are essential for ADAS to be able to sense, understand, and react to complicated situations on its own.

Additionally, the pursuit of autonomy encourages cooperation between the technology and automotive sectors, which in tu stimulates the creation of innovative solutions and a broader comprehension of how to deal with the difficulties associated with self-driving cars. As ADAS develops further to accommodate increased autonomy, it not only improves safety but also lays the groundwork for a revolution in transportation. The acceleration of autonomous driving research and development is not just an objective but also a force propelling constant innovation and radically changing our perceptions of the future of mobility and how we interact with cars.

Restraints:

The incorporation of advanced sensors, complex processing systems, and specialist software into automobiles results in significant production costs. The cost of this expenditure results in increased car pricing for buyers, which restricts the availability of ADAS-equipped cars, particularly in more cost-conscious market niches. The cost difference between conventional and ADAS-equipped cars is a barrier to widespread adoption, delaying the spread of these life-saving innovations throughout the automobile industry. Consumers are also conce ed about the value proposition of ADAS systems due to their cost, particularly when considering the apparent advantages of these systems.

Potential customers may be discouraged from purchasing ADAS systems by this cost barrier, which may outweigh the benefits of the enhanced safety and convenience provided by these systems. Moreover, manufacturers may find it difficult to explain the retu on investment due to the high initial cost of ADAS integration, particularly if market demand isn',t high enough to offset production expenses. It takes coordinated efforts to reduce production costs through technology developments, economies of scale, and effective manufacturing procedures in order to address the high starting cost constraint.

- Lack of Standardization and Interoperability

Different manufacturers', standards and technology make it more difficult for ADAS systems to integrate and work together seamlessly. Interoperability issues arise from this lack of consistency, which restricts the capacity of various parts and systems to interact with one another efficiently. Consequently, this hinders the process of developing standardized solutions that may be applied consistently throughout the automobile sector. The lack of standards also makes it more difficult to maintain, upgrade, and service cars with ADAS installed.

Different systems can be challenging for mechanics and service providers to handle, necessitating specific knowledge and equipment for every car make and model. Furthermore, this lack of consistency makes it difficult to comply with regulations and conduct testing protocols, which makes it more difficult to develop uniform safety standards. Establishing common frameworks, protocols, and interfaces within the sector is necessary to overcome the constraint of a lack of standardization and interoperability. Initiatives to standardize can promote system compatibility, simplify communication protocols, and make it easier to create ADAS solutions that are more unified and broadly applicable.

Opportunities:

- Integration of AI and Big Data Analytics

Big data analytics and AI algorithms together represent a paradigm shift in the way ADAS systems handle, examine, and make use of the enormous volume of data gathered from numerous sensors and sources. Because AI can lea from this data, adapt, and make decisions, it greatly improves safety measures by enabling ADAS to anticipate and prevent new hazards in addition to detecting and responding to present ones. Furthermore, real-time processing of complicated data streams is made possible by the combination of AI and big data analytics, which enables ADAS systems to comprehend complex traffic circumstances and make exceptionally accurate decisions in split seconds.

With the help of this integration, lea ing and development are further facilitated, and ADAS functionalities are improved over time in response to gathered data and practical experiences. The potential is in using AI-driven big data insights to improve the precision, dependability, and efficiency of ADAS features. This combination of technologies paves the way for enhanced hazard detection, predictive capabilities, and customized driving experiences. Moreover, the examination of large-scale data sets makes it easier to spot patte s, trends, and abnormalities, which makes it possible to create ADAS solutions that are more resilient and flexible.

- Expanding Electric and Connected Vehicle Market

Due to their advanced communication and sensor systems, electric vehicles (EVs) and connected cars offer an optimal platform for the smooth integration of ADAS features. The sophisticated architecture of these cars makes it easier to implement improved safety measures and fosters a more cohesive environment that is conducive to the success of ADAS. Driven by a desire for sustainability, electric vehicles require creative solutions for optimal performance and economical energy use.

With capabilities like adaptive cruise control, predictive energy management, and improved route planning, ADAS technologies support this endeavor and fit in seamlessly with the philosophy of electric vehicles. Furthermore, connected cars foster an atmosphere that is favorable to ADAS developments because of their capacity for communication with infrastructure and other vehicles. Real-time data interchange made possible by this link promotes more thorough and precise situational awareness. When combined with connected automobiles, ADAS systems can take use of this data sharing to improve safety precautions, foresee possible hazards, and offer drivers proactive help.

Segment Overview

- By Solution Type

Based on solution type, the global advanced driver assistance system market is divided into adaptive cruise control (ACC), blind spot detection system (BSD), park assistance, lane departure wa ing (LDWS) system, tire pressure monitoring system (TPMS), autonomous emergency braking (AEB), adaptive front lights (AFL), others. The adaptive cruise control category dominates the market with the largest revenue share in 2023. Long trips are made more convenient by the ability of vehicles to automatically alter their speed to maintain a safe distance from the car in front of them thanks to adaptive cruise control (ACC).

By using sensors to notify drivers of cars in their blind spots, the blind spot detection system (BSD) improves overall awareness and reduces the chance of crashes when changing lanes. Park assistance systems help drivers park by guiding or automatically guiding the car into a spot, which lowers the number of accidents caused by parking.

Lane departure wa ing systems (LDWS) wa drivers of inadvertent lane changes, averting possible collisions caused by drifting. To guarantee the best possible tire performance and safety, tire pressure monitoring systems (TPMS) track tire pressure and notify drivers when pressure is low. When an emergency arises, autonomous emergency braking (AEB) systems automatically apply the brakes to avoid or lessen collisions, greatly increasing vehicle safety. By modifying the headlights of the car according to the road, adaptive front lights (AFL) increase visibility.

- By Component Type

Based on the component type, the global advanced driver assistance system market is categorized into processor, sensors, software, others. The sensors category leads the global advanced driver assistance system market with the largest revenue share in 2023. A wide range of technologies, including cameras, radars, LiDAR, ultrasonic sensors, and more, are included in the crucial sensor segment. These sensors gather vital information about the environment around the car, which the ADAS may use to assess and respond to.

Software is essential to ADAS functions since it provides the brains behind them. Through the interpretation of sensor data by AI algorithms, machine lea ing models, and software applications, the system is able to identify barriers, anticipate dangers, and support driving activities. The core of ADAS is its processor, which manages the vast amount of data coming in from sensors and runs intricate algorithms. These processors, which are frequently strong and specialized, oversee the system',s decision-making and real-time data processing.

- By Vehicle Type

Based on vehicle type, the global advanced driver assistance system market is segmented into passenger car, commercial vehicle. The passenger car segment dominates the advanced driver assistance system market. Sedans, hatchbacks, SUVs, and other personal vehicles are all considered to be a major part of the ADAS industry. In order to meet the demands and preferences of specific customers, these technologies in passenger automobiles mainly concentrate on improving driver safety, convenience, and comfort. In order to enhance the overall driving experience for individuals and families, ADAS functionality in passenger cars frequently incorporate features like adaptive cruise control, lane departure wa ing, parking assistance, and collision avoidance systems.

Another significant market sector for ADAS products is commercial vehicles, which includes trucks, buses, vans, and other fleet vehicles. Commercial cars equipped with ADAS technologies prioritize operational effectiveness, cost-effectiveness, fleet management, and driver safety. Commercial vehicles that have these systems installed may have features including driver monitoring systems, route optimization, improved braking systems, and blind spot detection. The goals of ADAS in commercial vehicles are to improve fleet management and logistics overall, minimize accidents, maximize fuel efficiency, and increase safety.

Advanced Driver Assistance System Market Overview by Region

The global advanced driver assistance system market is categorized into North America, Europe, Asia-Pacific, and the Rest of the World. North America emerged as the leading region, capturing the largest market share in 2023. The region',s renown is the result of a confluence of advanced technology, a strong auto industry, and a commitment to vehicle safety.

Leading automakers, tech firms, and academic institutions are present, which creates a vibrant environment that is favorable to the development and application of ADAS. North America has also taken the lead in ADAS integration due to strict safety laws and a proactive approach to implementing new technologies. Vehicle safety is given top priority by regulatory organizations and safety standards in the US and Canada, which encourages the installation of cutting-edge safety technologies including adaptive cruise control, lane departure wa ing, and automated emergency braking.

The market has grown as a result of rising consumer awareness and demand for cars with cutting-edge safety features. The use of advanced driver assistance systems (ADAS) across a wider range of vehicle categories, including luxury and mainstream cars, has been driven by the region',s proclivity for innovation and early adoption of new automotive technologies. Partnerships between suppliers, IT companies, and automakers have advanced the field and made it possible to include more advanced ADAS features.

Advanced Driver Assistance System Market Competitive Landscape

In the global advanced driver assistance system market, a few major players exert significant market dominance and have established a strong regional presence. These leading companies remain committed to continuous research and development endeavors and actively engage in strategic growth initiatives, including product development, launches, joint ventures, and partnerships. By pursuing these strategies, these companies aim to strengthen their market position, expand their customer base, and capture a substantial share of the market.

Some of the prominent players in the global advanced driver assistance system market include

- Altera Corporation (Intel Corporation)

- Autoliv Inc.

- DENSO CORPORATION.

- Continental AG, Garmin Ltd.

- Infineon Technologies AG

- Magna Inte ational Inc.

- Mobileye

- Robert Bosch GmbH

- Valeo SA

- Wabco Holdings Inc,

Advanced Driver Assistance System Market Recent Developments

- In January 2023, The American auto radar maker NXP Semiconductors has introduced a new line of one-chip radar integrated circuits (ICs) for automated driving and advanced driver assistance systems. The SAF85xx series gives OEMs and tier-one suppliers more options by combining NXP',s cutting-edge radar detector and processing technologies into a single device.

Advanced Driver Assistance System Market Report Segmentation

| ATTRIBUTE | , , , , ,DETAILS |

| By Solution Type |

|

| By Component Type |

|

| By Vehicle Type |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

No FAQs available.

Report Details

- Published Date:Dec 20, 2023

- Format:PDF

- Language:English

- Delivery:Instant

Download Sample

Get a free sample report to preview the content and quality.