Auto Leasing Market Research Report: Information Based on Type (Passenger car rental, Passenger car leasing, Utility trailer, Recreational vehicle rental), By Leasing Type (Open, Closed), By End User Type (Industrial Divisions, Corporate Divisions), and Region (North America, Europe, Asia-Pacific, and Rest of the World) Global Industry Analysis, Size, Share, Growth, Trends, Regional Analysis, Competitor Analysis and Forecast 2023-2031.

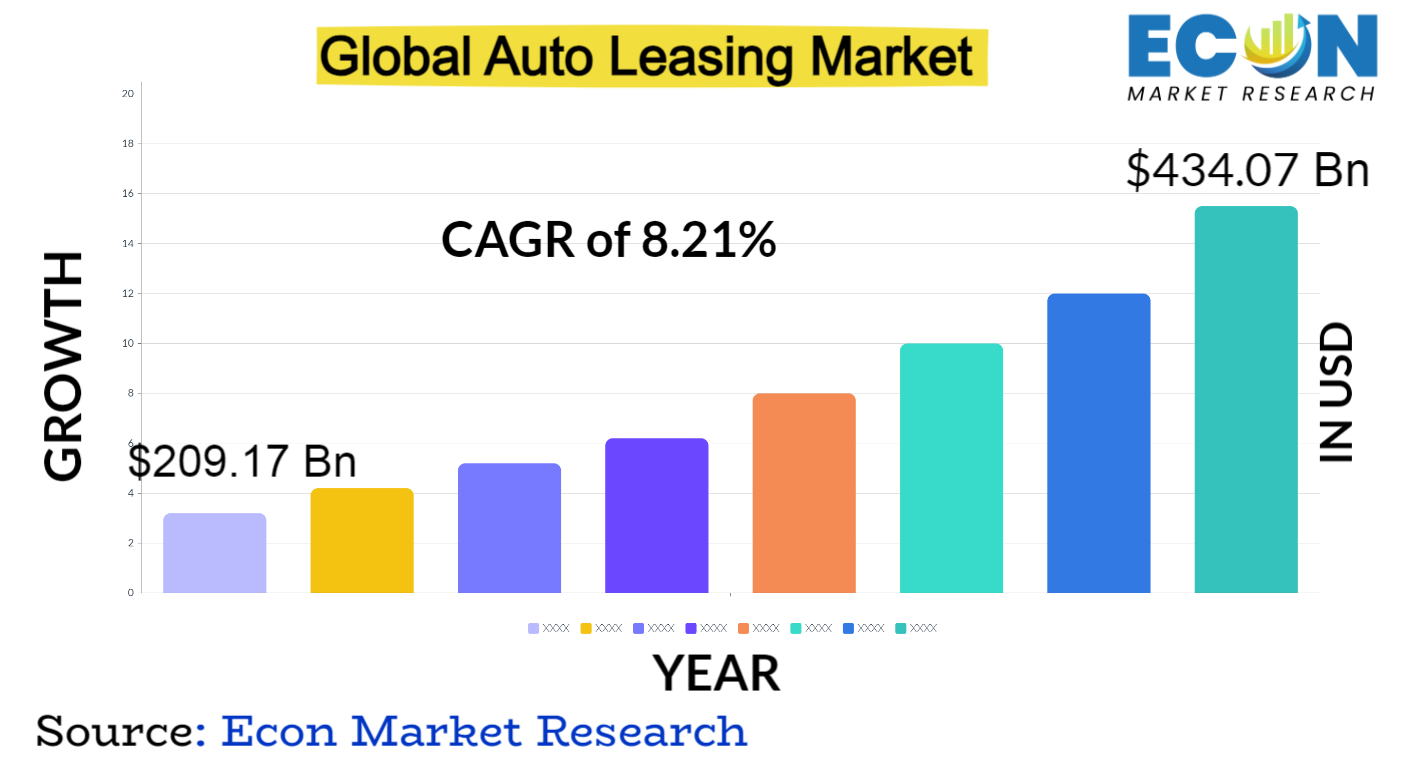

The Auto Leasing Market is predicted to reach approximately USD 434.07 billion by 2031, at a CAGR of 8.21% from 2022 to 2031.

The Automotive Rental and Leasing Market comprises businesses that offer automotive equipment renting or leasing services. These services are provided by entities such as organizations, sole traders, and partnerships, catering to the rental and leasing needs of passenger cars, trucks/vans, utility trailers, and recreational vehicles (RV) without drivers. Many of these businesses operate retail stores with dedicated departments for automotive equipment renting and leasing. They typically offer both short-term rentals and long-term leases, providing customers with a range of options. Renting and leasing automotive equipment or vehicles is an appealing alte ative for the automotive industry, offering advantages over outright purchases and allowing for increased job versatility with a wide selection of equipment.

| Report Attribute | Details |

| Estimated Market Value (2022) | USD 209.17 Bn |

| Projected Market Value (2031) | USD 434.07 Bn |

| Base Year | 2022 |

| Forecast Years | 2023 - 2031 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- Based on By Type, Leasing Type, End User Type &, Region. |

| Segments Covered | By Type, Leasing Type, End User Type &, Region. |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2031. |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa, and Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others. |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Auto Leasing Market Dynamics

The market for auto leasing is being pushed by the rise in flexible mobility solutions and the shift in views towards car ownership. The market dynamics are also influenced by economic considerations, technology developments, manufacturer and dealer programmes, and the competitive environment. Gove ment rules, environmental issues, and the move towards mobility-as-a-service all have an impact on the leasing market. The adaptability and experience-focused character of leasing are favored by changes in consumer behaviour, particularly among younger generations. The overall landscape of the vehicle leasing sector is still being shaped by these processes.

Auto Leasing Market Drivers

Opportunities in the automotive leasing market include broadening the range of available vehicles to include recreational vehicles, focusing on commercial customers for the leasing of lorries and utility trailers, offering operating leasing services for short to medium-term requirements, providing financial leasing solutions for long-term commitments, improving the customer experience through streamlined processes and customized packages, promoting sustainability with electric vehicle leasing options, and providing operating leasing services for short- to medium-term needs. Leasing companies can promote growth, provide a variety of consumer expectations, and maintain competitiveness in the market by taking use of these prospects.

Restraints:

The impact of fluctuating interest rates and economic conditions on lease pricing and affordability is substantial. Uncertainties about residual values and market conditions can also have an impact on leasing organizations&rsquo, profitability. Limited customer awareness and understanding of leasing choices impedes industry expansion even more. Furthermore, regulatory compliance requirements and potential legal complications impose administrative expenses on leasing firms. Overcoming these constraints requires smart solutions to limit risks and increase the attractiveness of auto leasing as a viable choice.

Opportunities:

The vehicle leasing business offers potential growth and development opportunities. The growing demand for flexible mobility solutions presents a big opportunity for leasing companies to offer customized lease terms and packages tailored to individual needs. The growing popularity of subscription-based models, which cater to clients wanting short-term or flexible car usage, provides another path for growth. Furthermore, the introduction of electric vehicles opens the door for leasing companies to offer environmentally responsible transportation solutions. Additionally, entering new areas and focusing on specialist categories such as luxury or commercial cars might lead to further market expansion and diversification.

Segment Overview

- Based on Type

The Automotive Rental and Leasing Market is organized into four segments: passenger car rental, passenger car leasing, truck, utility trailer, and recreational vehicle rental and leasing. The largest percentage is held by passenger automobile rental, followed by truck, utility trailer, and RV rental and leasing, and passenger car leasing. The expansion of the passenger automobile rental category can be ascribed to the several advantages it offers, such as cost-effective travel, affordability, comfort, and an improved quality of life.

- By Leasing Type

The Automotive Rental and Leasing Market is divided into open and closed categories based on the kind of lease. The market is dominated by the open segment. Individuals accept the risk of depreciation under an open-end lease, and the entire cost of ownership is calculated only when the vehicle is remarketed.

- By End User Type

Based on end users, the automotive rental and leasing market is segmented into industrial and corporate divisions. The industrial category currently has the largest market share and is predicted to grow at the fastest rate throughout the projection period.

Auto Leasing Market Overview by Region

- Asia-Pacific

The vehicle leasing market is positioned to dominate the Asia-Pacific area. There is a huge demand for adaptable mobility solutions due to the quick urbanisation and population growth in nations like China and India, which makes leasing a vehicle a desirable choice. Second, the expanding middle-class population, rising disposable incomes, and shifting consumer preferences towards affordability and convenience all contribute to the market',s growth.

Additionally, the existence of well-established leasing organisations and their efforts to extend their operations in the area, along with developments in digital technology, promote easy lease transactions. Finally, encouraging gove ment actions and laws that support electric and sustainable transportation solutions give the Asia-Pacific region',s vehicle leasing market an extra push.

- North America

North America currently accounts for the biggest revenue share in the worldwide automotive leasing market. These approaches include implementing IoT technology to effectively manage car fleets and cut expenses, implementing blockchain technology to increase the dependability of leasing procedures, and integrating machine lea ing into car leasing services. These developments aid in streamlining processes, increasing effectiveness, and providing better leasing experiences in the North American market.

Auto Leasing Market Competitive Landscape

The competitive environment in the vehicle leasing business is dynamic and ever-evolving as both new companies and established firms adjust to shifting customer preferences and technology improvements. Despite the continued dominance of traditional leasing companies, the rise of inte et platforms and subscription-based business models has the potential to upend the sector and encourage innovation. Some of the prominent players in the Global Auto Leasing Market are

- Expedia Group Inc,

- LeasePlan,

- Aspark Holidays Pvt. Ltd.,

- Avis Budget,

- BlueLine Rental,

- Enterprise Holdings,

- Europcar Mobility Group SA,

- Expedia Group Inc.,

- Green Motion Inte ational,

- Mercedes Benz Group AG,

- The Hertz Corporation.

Auto Leasing Market Recent Developments

- June 2023 ,Diageo India has launched the zesty Tanqueray Rangpur and the captivating Tanqueray Mallaca. ,MG Motor, a subsidiary of the Chinese automaker SAIC Motor, has unveiled a new leasing promotion in which drivers in France can lease the MG4 electric car for 99 euros ($107.6) per month. This initiative aligns with a program supported by the French gove ment to promote the use of European-made cars.

Global Auto Leasing Market Report Segmentation

| ATTRIBUTE | , , , , , DETAILS |

| Based on Type |

|

| By Leasing Type |

|

| By End User Type |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

No FAQs available.

Report Details

- Published Date:Jan 5, 2024

- Format:PDF

- Language:English

- Delivery:Instant

Download Sample

Get a free sample report to preview the content and quality.