Automotive Brake System Market Research Report: By Type (Disc and Drum), By Technology (Antilock Braking System (ABS), Traction Control System (TCS), Electronic Stability Control (ESC), and Electronic Brake Force Distribution (EBD)), By Vehicle Type (Passenger ICEx Vehicle, Commercial ICE Vehicle, and Electric Vehicle), By Sales Channel (OEM and Aftermarket), and Region (North America, Europe, Asia-Pacific, and Rest of the World) Global Industry Analysis, Size, Share, Growth, Trends, Regional Analysis, Competitor Analysis and Forecast 2024-2032.

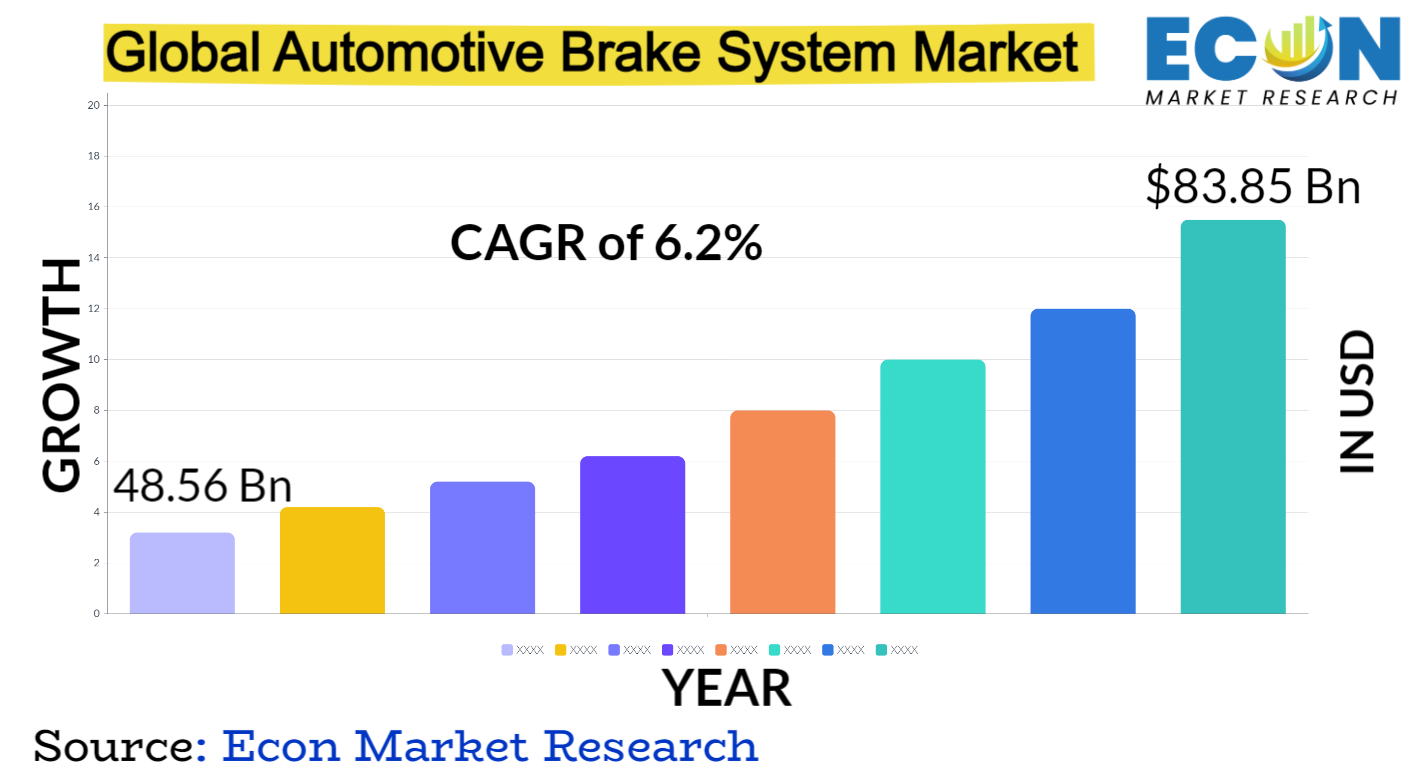

The Automotive Brake System Market was valued at USD 48.56 billion in 2023 and is estimated to reach approximately USD 83.85 billion by 2032, at a CAGR of 6.2% from 2024 to 2032.

Since its establishment, the market for vehicle brake systems has seen a revolutionary change. The environment of this business has evolved significantly since the late 19th century, when manually controlled systems were common. Fred Duesenberg made a significant advancement in safety and efficiency when he invented hydraulic brakes at the beginning of the 20th century. Progressive inventions that revolutionized car safety over time included the anti-lock braking systems (ABS) developed by Bosch in the 1970s.

In response to consumer requests for safer, more responsive automobiles, the industry has continued to grow with the introduction of electronic brake systems, regenerative braking, and autonomous emergency braking. Regenerative braking systems are being included into electric and hybrid vehicles as part of emerging trends that emphasize environmental solutions. In addition, technical developments such as predictive braking algorithms and brake-by-wire systems demonstrate the industry',s continuous dedication to safety and innovation. The development of automotive braking systems from simple manual systems to complex, technologically-driven solutions highlights the industry',s continuous progress, with mode cars placing a premium on sustainability, efficiency, and safety.

| Report Attribute | Details |

| Estimated Market Value (2023) | 48.56 Bn |

| Projected Market Value (2032) | 83.85 Bn |

| Base Year | 2023 |

| Forecast Years | 2024 - 2032 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Type, By Technology, By Vehicle Type, By Sales Channel, &, Region |

| Segments Covered | By Type, By Technology, By Vehicle Type, By Sales Channel, &, Region |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2024 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa, and the Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Automotive Brake System Market Dynamics

Safety is still the top priority, which is driving the need for more sophisticated braking systems. Globally enforced gove ment laws that set strict requirements for car safety have a constant impact on market dynamics. Manufacturers invest in R&,D for novel brake systems because of the importance of consumer awareness and desires for improved safety features, comfort, and vehicle performance.

The market is changing as a result of the move toward electric and hybrid cars, which is encouraging the incorporation of regenerative braking systems to increase energy efficiency. Furthermore, the industry is being driven to develop intelligent braking solutions by the need for highly responsive and sophisticated brake systems brought about by growing mobility trends such as driverless vehicles. Industry alliances, partnerships, and mergers support innovation in technology and increase market share. Cost factors also have a big impact on market dynamics and how different brake system technologies are adopted, especially in emerging economies. All things considered, the automotive braking system market is a dynamic combination of consumer preferences, market competitiveness, safety requirements, technology advancements, and regulatory frameworks that interact to drive industry growth and transformation.

Automotive Brake System Drivers

- Increasing Consumer Demand for Advanced Safety Features

Customers are placing a higher priority on cars with cutting-edge safety features as they become more conce ed about safety. In this situation, brake systems are essential because they are the main safety feature. Autonomous emergency braking (AEB), electronic stability control (ESC), collision avoidance systems, and anti-lock braking systems (ABS) are now important features that affect buying decisions. Reliable brake systems that improve vehicle control and reduce road hazards are what consumers look for when they',re looking for assurance.

Increased awareness of traffic safety and laws requiring the installation of specific safety systems in cars both contribute to this need. To meet these demands, automakers and suppliers of brake systems are always coming up with new and advanced braking technologies that provide better performance, reduced stopping distances, and increased vehicle stability. The market is driven by the convergence of consumer preferences and technological advancements in brake systems, making safety features mandatory rather than optional. This creates a competitive environment that keeps brake technology innovation at the forefront of the automotive industry.

- Technological Advancements

Brake system capabilities have been transformed by the ongoing development of materials, sensors, computational power, and connection. These developments make it easier to create brake systems that are more effective, responsive, and intelligent. Advances in sensor technology allow for sophisticated control of braking systems by precisely monitoring several parameters such as wheel speed, pressure, and vehicle dynamics. Furthermore, the use of machine lea ing and artificial intelligence algorithms improves the predictive capabilities of brake systems, allowing for proactive reactions to evolving road conditions.

Furthermore, improvements in materials science help to create brake components that are lighter, stronger, and resistant to heat, all of which improve performance and lifespan. Furthermore, by facilitating data interchange for predictive brake responses, the convergence of braking systems with vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication technologies enhances safety and efficiency. The unrelenting quest of technical innovation, as demonstrated by regenerative braking systems that absorb and transform kinetic energy into useful electrical energy, not only improves safety but also addresses environmental issues.

Restraints:

- Higher Manufacturing and Implementation Costs

The car industry is significantly hampered by higher implementation and production costs, especially when it comes to brake systems. The incorporation of sophisticated technologies, such artificial intelligence algorithms, precise sensors, and specialty materials needed for contemporary brake systems, drives up manufacturing costs dramatically. These expenses are additionally increased by investments in research and development to guarantee adherence to strict safety requirements and laws. Furthermore, the cost of implementing these cutting-edge brake systems is increased when old cars are modified or redesigned to fit them. These rising expenses are problematic, particularly in regions where consumers are price-conscious and still have a strong need for reasonably priced cars.

Manufacturers must strike a balance between offering low prices and adding state-of-the-art safety features. High prices are also a result of the intricacy of manufacturing procedures and the requirement for specialized knowledge. Therefore, these increased costs associated with production and deployment may prevent advanced brake systems from being widely adopted and accessible. To counteract this limitation and increase the accessibility of these vital safety features in the automotive industry, creative and economical solutions will be needed.

- Complexity in Integration

Complex issues arise when mode brake systems are incorporated into existing vehicle architectures as cars evolve with new technologies. For these sophisticated systems to be successfully integrated, the integration process frequently necessitates painstaking engineering modifications, possible redesigns, or adaptations. There may be incompatibilities between different car parts and the brake system itself. These require extensive testing and certification, which adds to the cost and delays development. Furthermore, as automobiles become more electronically controlled and networked, complicated braking systems are incorporated into this network, adding to its complexity.

The task of integrating these technologies is made more difficult by the need to balance their performance needs with those of the vehicle',s current functionalities. Another layer of complication is added by the requirement for professionals to have certain knowledge and training to perform installation and maintenance. All things considered, this integration complexity raises costs and lengthens development cycles, which presents a major obstacle for manufacturers trying to seamlessly integrate new brake systems into contemporary automobiles.

Opportunities:

- Electric and Hybrid Vehicle Integration

Specialized brake solutions are necessary for these alte ative propulsion systems, providing a rare opportunity for innovation and uniqueness. One important component of electric and hybrid cars is regenerative braking, which allows kinetic energy to be converted into electrical energy while braking, increasing performance and range. Manufacturers of brake systems have the opportunity to develop and advance regenerative braking technologies, enhancing their dependability and performance in these changing vehicle platforms.

Brake systems that can work flawlessly with these propulsion systems are becoming more and more necessary as the demand for electric and hybrid vehicles rises. This creates opportunities for manufacturers of brake systems to create customized products that address the unique features of electric and hybrid cars, like quick energy recovery, long brake life, and adaptive braking control. Manufacturers can meet the demand for more efficient braking and position themselves at the forefront of a growing market segment by matching brake system advancements with the specific needs of electric and hybrid vehicles. This will drive innovation and shape the future of automotive braking technology.

- Autonomous and Connected Vehicles

The market for automotive brake systems has a revolutionary opportunity in the form of autonomous and connected vehicles. High-tech cars like this require extremely complex and clever braking systems to guarantee improved performance and safety. Brake systems must be developed to meet the needs of autonomous vehicles by offering prompt and accurate reactions, matching the vehicle',s sophisticated sensor and AI-powered decision-making capabilities. Furthermore, the incorporation of connection elements facilitates communication between the brake systems and other parts of the vehicle as well as exte al data sources. This allows predictive braking algorithms to anticipate and adjust to changing driving circumstances instantly.

The opportunity to develop in areas like improved sensors, smart control systems, and brake-by-wire technology allows braking system manufacturers to customize solutions for the unique requirements of connected and autonomous vehicles. Manufacturers may establish themselves as key collaborators in defining the efficiency and safety requirements of tomorrow',s transportation by creating dependable, high-performance brake systems that fit into these futuristic vehicle architectures with ease.

Segment Overview

- By Type

Based on type, the global automotive brake system market is divided into disc and drum. The disc category dominates the market with the largest revenue share in 2023. A rotor (disc), caliper, brake pads, and hydraulic parts make up a disc brake. The rotor and wheel are attached, and the rotor spins together. The brake pads are forced against the rotor',s surface when the brake pedal is depressed, creating friction that slows down the car. Better heat dissipation is a feature of disc brakes, which means they brake consistently even in high-stress situations. They have a reputation for having effective stopping power, cooling down more quickly, and generally having less brake fade incidents, which are caused by overheating.

The components of a drum brake system include braking shoes, a housing shaped like a drum, a wheel cylinder, springs, and additional hardware. Hydraulic pressure pushes the brake shoes up against the drum',s inner surface when the brake pedal is depressed, slowing down the car. Drum brakes are generally less complicated to make and assemble, which lowers their manufacturing costs. They are frequently seen in parking brake systems and rear-wheel applications.

- By Technology

Based on the technology, the global automotive brake system market is categorized into antilock braking system (ABS), traction control system (TCS), electronic stability control (ESC), and electronic brake force distribution (EBD). The electronic stability control (ESC) category leads the global automotive brake system market with the largest revenue share in 2023. ESC aids in preserving the stability and control of the car, particularly when braking or co ering suddenly. It continuously tracks the movement of the vehicle and corrects oversteer or understeer by braking specific wheels or changing engine torque, so averting loss of control and possible rollover incidents. TCS controls the power delivered to the wheels in order to prevent wheel slippage or loss of traction during acceleration.

By decreasing engine power or applying brakes to the spinning wheel, it controls wheel spin and enhances traction on terrain with uneven grip levels, including snowy or rainy roadways. With the help of ABS, a safety function that keeps wheels from locking up when braking, the driver may continue to control the steering even when applying strong brakes or driving on slick surfaces. It works by varying the amount of brake pressure applied to specific wheels, allowing them to continue tu ing even when braking, which helps to minimize skidding and improves overall vehicle stability. Based on a number of variables, including vehicle load, road conditions, and braking dynamics, EBD optimizes the distribution of brake force among the wheels. It makes sure that every wheel has equal braking power, which improves stability and reduces stopping distances, particularly in emergency situations.

- By Vehicle Type

Based on vehicle type, the global automotive brake system market is segmented into passenger ICEx vehicles, commercial ICE vehicles, and electric vehicles. The passenger ICEx vehicles segment dominates the automotive brake system market. Gasoline or diesel-powered inte al combustion engine (ICE) passenger cars have historically accounted for a significant share of the market. These cars', brake systems are always improving in terms of efficiency, performance, and safety. Mode cars come equipped with disc braking systems, ABS, and ESC, among other advanced technologies that provide better stability and stopping force for a range of car sizes and road conditions. trucks, buses, and vans are examples of commercial vehicles with unique brake system requirements because of their higher weights and frequent stop-and-go traffic. These cars frequently have strong braking systems that can sustain higher loads and provide steady performance over long stretches of time.

The integration of advanced brake technologies, like EBD and TCS, guarantees the best possible braking performance under a range of cargo weights and road conditions. The introduction of electric vehicles has caused a radical change in the architecture of brake systems. Regenerative braking systems are used by electric cars (EVs), such as battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), to capture and transform kinetic energy into electrical energy, increasing range and efficiency. In order to minimize wear and maximize energy efficiency, brake systems in electric vehicles (EVs) frequently work in tandem with regenerative braking. This blends classic friction-based braking with energy recuperation.

- By Sales Channel

Based on sales channels, the global automotive brake system market is divided into OEM and aftermarket. The aftermarket category dominates the market with the largest revenue share in 2023. Brake system parts, systems, and components that are supplied and installed independently of OEM assembly are included in the aftermarket market. Aftermarket brake systems serve owners of automobiles looking to upgrade, replace, or improve the performance of their current vehicles. Aftermarket brake components may be chosen by consumers for a variety of reasons, including the necessity to replace wo -out or broken OEM parts, brand preferences, performance enhancements, and customization choices.

Brake systems installed by manufacturers at the time of initial vehicle assembly are included in the OEM section. Before cars are put up for sale, these braking systems are installed in them. Vehicle manufacturers choose and develop original equipment (OEM) brake systems to satisfy strict safety, performance, and legal requirements. In order to provide customized solutions that enhance the overall appearance and desired performance characteristics of the vehicle, automakers frequently work with suppliers of brake systems.

Automotive Brake System Overview by Region

The global automotive brake system market is categorized into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific emerged as the leading region, capturing the largest market share in 2023. The need for brake systems has been driven by the region',s sizable automobile manufacturing base, especially in nations like China, Japan, South Korea, and India. This expansion has been supported by a rising middle-class population, fast urbanization, and rising vehicle ownership. Stricter safety laws and the incorporation of cutting-edge braking systems in cars have also boosted the market. Asia-Pacific is leading the way in the growth of the automotive braking system market because of its manufacturing capability, rising vehicle demand, and attention to safety.

The automotive braking system market in North America is expected to grow at a high Compound Annual Growth Rate (CAGR) over the forecast period. The need for sophisticated braking technologies, such as autonomous emergency braking systems (ESC), ABS, and other braking systems, is driven by the region',s ongoing focus on car safety standards and regulations. Second, the growing popularity of hybrid and electric cars in North America is driving the development of specialist brake systems for these environmentally friendly automobiles. The strong automotive aftermarket sector in the area, where buyers look for enhanced or replacement braking systems for their current cars, also plays a role in the increase that is predicted.

The automotive braking system market in North America is expected to grow at a high Compound Annual Growth Rate (CAGR) over the forecast period. The need for sophisticated braking technologies, such as autonomous emergency braking systems (ESC), ABS, and other braking systems, is driven by the region',s ongoing focus on car safety standards and regulations. Second, the growing popularity of hybrid and electric cars in North America is driving the development of specialist brake systems for these environmentally friendly automobiles. The strong automotive aftermarket sector in the area, where buyers look for enhanced or replacement braking systems for their current cars, also plays a role in the increase that is predicted.

Automotive Brake System Competitive Landscape

In the global automotive brake system market, a few major players exert significant market dominance and have established a strong regional presence. These leading companies remain committed to continuous research and development endeavors and actively engage in strategic growth initiatives, including product development, launches, joint ventures, and partnerships. By pursuing these strategies, these companies aim to strengthen their market position, expand their customer base, and capture a substantial share of the market.

Some of the prominent players in the global automotive brake system market include,

- AKEBONO BRAKE INDUSTRY CO., LTD

- ZF Friedrichshafen AG

- ADVICS CO.,LTD.

- Hitachi Astemo, Ltd.

- Brembo S.p.A

- Robert Bosch GmbH

- AISIN CORPORATION

- Haldex

- The Web Co

- NISSIN KOGYO Co., Ltd., and various others.

Automotive Brake System Recent Developments

- In June 2023, The fully-floating, two-piece disc high-performance brake pad alte atives that EBC Brakes Racing has developed especially for the new G87 BMW M2 are their newest offering. EBC Brakes Racing takes the lead with this release, being among the first manufacturers to offer aftermarket performance parts for this eagerly awaited car.

- In March 2023, Together, SSAB and MENETA have revealed the world',s first car brake components and sealing materials made of steel that doesn',t come from fossil fuels, marking a crucial tu ing point in the automobile industry. The partnership between MENETA, a top provider of braking systems, and SSAB, a world leader in the manufacture of high-strength steel, shows their dedication to lowering carbon emissions and switching to more environmentally friendly materials.

Automotive Brake System Market Report Segmentation

| ATTRIBUTE | , , , , DETAILS |

| By Type |

|

| By Technology |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

No FAQs available.

Report Details

- Published Date:Jan 1, 2024

- Format:PDF

- Language:English

- Delivery:Instant

Download Sample

Get a free sample report to preview the content and quality.