Automotive LiDAR Market Research Report: By Type (Time of Flight (ToF), Frequency-Modulated-Continuous-Wave (FMCW)), By Technology (Solid-state, Electro-mechanical), By Image Type (2 Dimensional, 3 Dimensional), By Vehicle Type (Internal Combustion Engine (ICE), Hybrid, Battery Electric), By Application (Semi-autonomous Vehicles, Autonomous Vehicles), and Region (North America, Europe, Asia-Pacific, and Rest of the World) Global Industry Analysis, Size, Share, Growth, Trends, Regional Analysis, Competitor Analysis and Forecast 2024-2032.

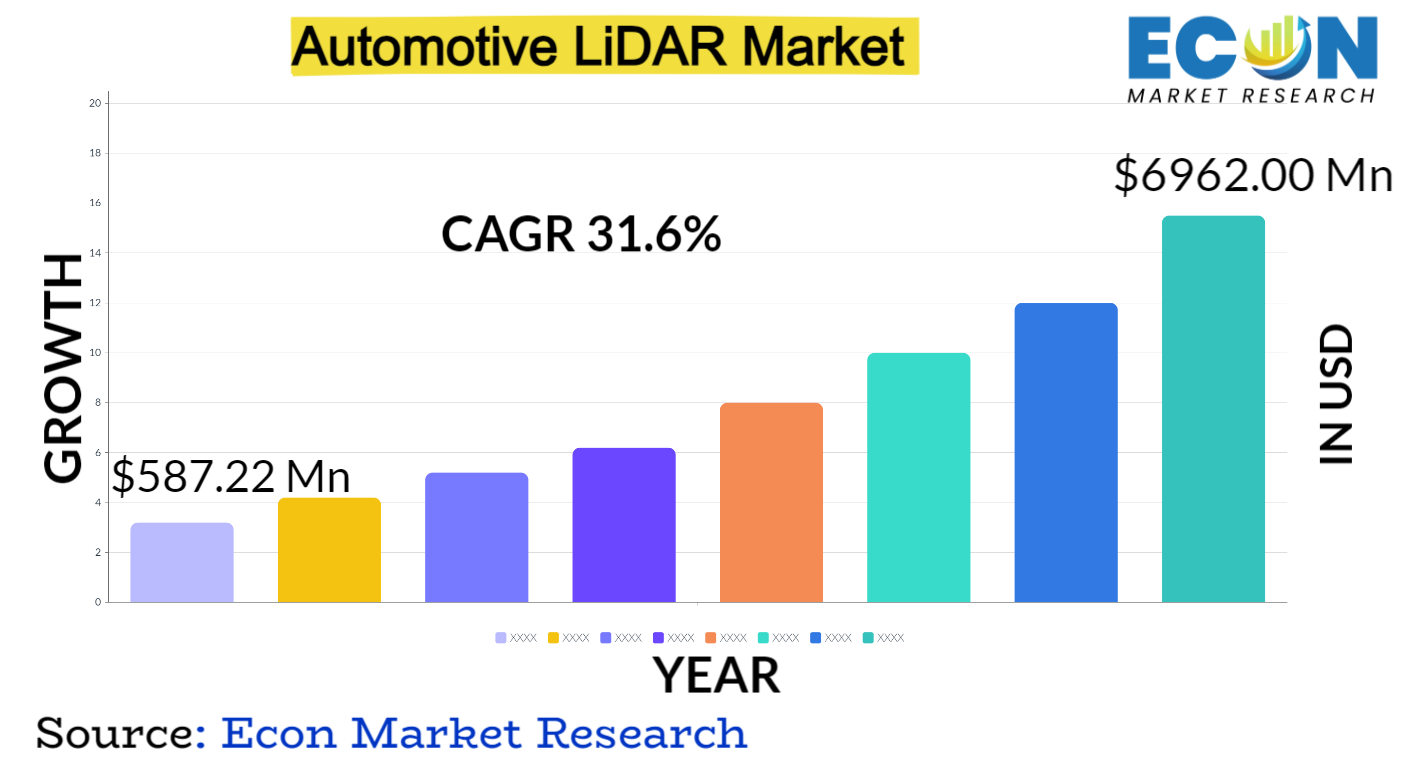

The Automotive LiDAR Market was valued at USD 587.22 million in 2023 and is estimated to reach approximately USD 6962.00 million by 2032, at a CAGR of 31.6% from 2024 to 2032.

When automotive LiDAR was introduced as a game-changing technology in the early 2000s, the market saw a revolutionary rise. The automotive industry was completely transformed by LiDAR, or light detection and ranging, which uses laser pulses to provide sophisticated depth perception and object detecting capabilities. Its incorporation into automobiles facilitated accurate object detection, mapping, and localization, which in tu promoted the advancement of autonomous driving technologies. LiDAR was first used in research and experimental vehicles, but because of its potential to improve vehicle safety and navigation, tech entrepreneurs and big automotive players quickly became interested in it.

As technology progressed, LiDAR systems became more affordable and smaller, increasing their viability for use in commercial vehicles. There was a sharp increase in competition in the industry, which encouraged innovation to produce LiDAR solutions that were more dependable, economical, and efficient. With its capacity to produce intricate 3D maps instantaneously and offer vital information for secure navigation, the automotive LiDAR market developed as a critical element in reaching increasingly advanced degrees of vehicle autonomy. It is now leading the way in automotive innovation and has the potential to further transform transportation by making autonomous driving experiences safer and more effective.

AUTOMOTIVE LIDAR MARKET: REPORT SCOPE &, SEGMENTATION

| Report Attribute | Details |

| Estimated Market Value (2023) | 587.22 Mn |

| Projected Market Value (2032) | 6962.00 Mn |

| Base Year | 2023 |

| Forecast Years | 2024 - 2032 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Type, By Technology, By Image Type, By Vehicle Type, By ,Application, &, Region |

| Segments Covered | By Type, By Technology, By Image Type, By Vehicle Type, By ,Application, &, Region |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2024 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa, and the Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Automotive LiDAR Market Dynamics

The pursuit of autonomous vehicles and the quick development of sensor technologies have been key factors. Early issues were mostly related to bulkiness and high costs, which prompted continuous efforts to minimize production costs and miniaturize. A competitive ecosystem is created as market competitors compete to build LiDAR systems that strike a compromise between performance, affordability, and scalability. Market dynamics are greatly impacted by industry standards and regulatory developments. LiDAR adoption is directly influenced by changing legislation conce ing autonomous vehicle testing and safety standards.

The market environment is further shaped by alliances and partnerships between LiDAR developers, tech firms, and automakers. Mergers and investments have an impact on market trends as well, encouraging innovation and extending the application of LiDAR technology to a wider range of vehicle classes. The need and adoption of autonomous features by consumers are important factors. The market for automotive LiDAR is expected to develop as consumers', trust in autonomous technology increases and they demand more safety features. In addition, market dynamics are impacted by geopolitical variables, supply chain interruptions, and the worldwide trend toward sustainability. These factors have an effect on the manufacturing, distribution, and adoption rates of LiDAR technology in the automobile industry. All things considered, the automotive LiDAR industry continues to be extremely sensitive to a wide range of constantly changing elements, which promotes an atmosphere of innovation and change.

Automotive LiDAR Market Drivers

- Autonomous Vehicle Development

By combining cutting-edge technologies like LiDAR, radar, cameras, and artificial intelligence, autonomous vehicles (AVs) seek to revolutionize mobility by allowing vehicles to function without the need for human interaction. The main motivation for this project is to increase convenience, efficiency, and safety. With their promise to drastically lower human error-related traffic accidents, autonomous vehicles (AVs) provide a safer mode of transportation. Moreover, AV development is highly motivated by the possibility of boosted productivity during commutes, decreased traffic, and optimized fuel use.

Autonomous vehicles have a driver that goes beyond convenience and safety. It includes a more comprehensive strategy for accessibility, sustainability, and urban planning. AVs have the power to completely change cities by changing the layout of the infrastructure, eliminating the need for parking spots, and enhancing traffic flow in general. Additionally, they provide chances for people who are elderly or have disabilities by enhancing their mobility and freedom. Global cooperation among automakers, tech firms, and gove ments has been spurred by the race to build autonomous vehicles (AVs), creating an ecosystem aimed at transforming transportation.

- Ongoing Innovations in LiDAR Technology

These developments consistently push the limits of LiDAR',s capabilities, emphasizing important features including cost reduction, greater resolution, longer range, and downsizing. One notable innovation is the creation of solid-state LiDAR, which aims to do away with moving parts, improve reliability, and lower production costs, thereby making the technology more accessible for mass adoption. Furthermore, advances in data analysis and signal processing techniques lead to better object recognition, making it possible for LiDAR to detect and categorize things more precisely.

The advancement of photonics and MEMS (Micro-Electro-Mechanical Systems) technologies hastens the shrinking and performance improvements of LiDAR sensors. These continuous advancements are fueled by the unwavering desire to overcome current obstacles and satisfy the expanding needs of many industries. The industry',s dedication to broadening applications across industries, promoting safer autonomous vehicles, enhancing environmental monitoring, improving urban planning, and supporting cutting-edge research initiatives is reflected in the race to build more compact, cost-effective, and efficient LiDAR systems.

Restraints:

Elevated production costs are a result of the extensive manufacturing procedures required to create LiDAR sensors, which include precise laser systems, high-quality optics, and delicate electrical components. Unit costs are further increased by the fact that large-scale production is still in its very early stages and presents difficulties with economies of scale. The integration of LiDAR technology into a wider range of applications is limited because to its high production costs, which have a direct impact on its affordability and accessibility. Another obstacle is the initial cost involved in researching, developing, and implementing LiDAR systems.

Businesses that invest in LiDAR technology must pay high upfront expenses for the development, testing, and certification of systems that are customized to meet industry standards. Because these expenditures require a lot of resources, smaller businesses and startups are frequently discouraged from entering the market, which reduces the variety of options available and slows down the rate of innovation. As a result, these financial constraints make adoption more difficult overall, especially in industries where scalability and cost-effectiveness are important considerations when deciding which technologies to adopt.

- Infrastructure and Standardization Challenges

For effective operation, LiDAR systems need a strong infrastructure that supports data processing, networking, and interoperability with other systems. Its deployment is complicated, nevertheless, by the lack of infrastructure and defined protocols designed specifically for LiDAR integration. The absence of defined frameworks makes it difficult for various LiDAR systems and platforms to communicate with one another, which leads to compatibility problems and complicates the development of coherent, scalable solutions.

The lack of uniform laws or policies gove ing the use of LiDAR in different sectors and geographical areas creates uncertainty. Implementation becomes fragmented and delayed due to differing regulatory contexts and standards gove ing LiDAR integration in autonomous vehicles, urban planning, or infrastructure development. The absence of standardization in rules and infrastructural prerequisites poses challenges for enterprises seeking to implement LiDAR technology in diverse markets, hence influencing their investment choices and deployment tactics. In order to create coherent frameworks and norms, industry players, legislators, and standardization bodies must work together to address infrastructure and standardization conce s.

Opportunities:

- Advancements in Sensor Technology

The goal of sensor technology advancement is to improve LiDAR performance by emphasizing important factors including resolution, scalability, cost, and range. Solid-state LiDAR, which makes use of semiconductor-based components, represents a major advancement. This innovation aims to reduce production costs by doing away with moving elements, which also reduces complexity and improves reliability. Furthermore, as semiconductor fabrication techniques advance, sensors become smaller and more efficient, opening the door for LiDAR systems that are both compact and highly effective.

Enhancing the resolution and range of LiDAR sensors is another aspect of sensor technology innovations. LiDAR systems are becoming more and more applicable in a variety of industries and locations due to their capacity to collect finer details over longer distances with more precision thanks to advancements in optics, laser sources, and signal processing algorithms. Furthermore, advances in photonics and micro-electro-mechanical systems (MEMS) facilitate the development of more compact and resilient sensors, opening up new avenues for integration into a wider range of platforms and devices outside of the conventional automotive and mapping domains.

- Rising Demand for Safety Features

Advanced driver-assistance systems (ADAS) and collision avoidance technologies are becoming more and more important as consumer awareness of road safety grows and safety rules become stricter. Because of its accurate object identification, range, and real-time 3D mapping capabilities, LiDAR is a key tool for improving vehicle safety. LiDAR',s capacity to deliver precise and thorough data about a vehicle',s surroundings is in line with the growing demand for safety features, since it allows for quicker and more accurate reactions to possible risks.

Overall safety precautions are improved by its ability to detect objects in any lighting situation, including low visibility or nighttime situations. LiDAR helps ADAS features like adaptive cruise control, automated emergency braking, and pedestrian recognition meet consumer demand for cars with these cutting-edge safety features. Furthermore, a favorable atmosphere for LiDAR technology integration is created by consumers', growing awareness of safety regulations and desire to spend money on cars with strong safety features. As LiDAR develops further, providing better performance, lower prices, and increased dependability, it becomes easier to address the growing need for safety features in automobiles.

Segment Overview

- By Type

Based on type, the global automotive LiDAR market is divided into time of flight (ToF), frequency-modulated-continuous-wave (FMCW). The time of flight (ToF) category dominates the market with the largest revenue share in 2023. ToF LiDAR calculates distances using the round-trip time of light pulses, which is measured as the amount of time it takes to reach an object and back. By carefully timing the light',s reflection, this technique provides extensive 3D mapping and object detection, making it possible to calculate distances accurately.

Nevertheless, ToF LiDAR',s cost and effectiveness are typically impacted by the need for powerful lasers and complex sensors. ,FMCW LiDAR uses continuous, variable-frequency laser beams to function. To calculate an object',s distance, it analyzes the difference in frequency between signals that are transmitted and reflected. FMCW LiDAR has benefits such as reduced power usage, enhanced sensitivity to velocity measurements, and possible cost savings because of less complex hardware needs.

- By Technology

Based on the technology, the global automotive LiDAR market is categorized into solid-state, electro-mechanical. The solid-state category leads the global automotive LiDAR market with the largest revenue share in 2023. Solid-state LiDAR emits and receives laser pulses using solid-state components, such as semiconductor materials and microelectronic architectures. This system uses stationary components to control lasers and identify reflections of retu ed light instead of moving parts. Because solid-state LiDAR does not rely on mechanical components, it has advantages in terms of strength, dependability, and compactness. ,

In order to direct laser beams and detect reflected light, electro-mechanical LiDAR systems usually include moving parts, such as oscillating motors or revolving mirrors. Precise mapping of the surroundings is made possible by these moving components, which make scanning and detection easier. Moving parts, on the other hand, might lead to wear-and-tear vulnerabilities that could compromise lifetime and dependability.

- By Image Type

Based on image type, the global automotive LiDAR market is segmented into 2 dimensional, 3 dimensional. The 2 dimensional segment dominates the automotive LiDAR market. The main output of 2D LiDAR systems is a depiction of the surrounding area in flat, horizontal planes. These systems usually provide information on the locations and lengths of items along a certain plane by scanning and mapping in a single plane. They work well in circumstances involving simple obstacle identification or in some industrial environments where a flat representation is sufficient. But 3D systems provide depth and fine-grained spatial information that 2D LiDAR does not.

3D LiDAR systems are able to obtain a thorough three-dimensional picture of the surroundings. These multi-dimensional scanning systems offer depth information, accurate object detection, and comprehensive spatial mapping. They produce a more comprehensive picture of the environment, making it possible to precisely identify objects at different heights and distances.

- By Vehicle Type

Based on vehicle type, the global automotive LiDAR market is divided into , inte al combustion engine (ICE), hybrid, battery electric. The inte al combustion engine (ICE) category dominates the market with the largest revenue share in 2023. The classic gasoline or diesel-powered automobiles are known as inte al combustion engine (ICE) vehicles. By integrating LiDAR technology, these cars hope to improve their safety features and make advanced driver-assistance systems (ADAS) more capable of autonomous driving and accident avoidance. With precise environmental mapping and object recognition, this integration aims to increase the efficiency and safety of traditional cars.

Hybrid cars promise lower pollutants and better fuel economy by combining an inte al combustion engine with an electric motor and battery. LiDAR integration in hybrid vehicles seeks to enhance the capabilities of their current sensor systems, hence improving safety particularly in urban areas and advancing the development of partially or conditionally autonomous hybrid vehicles. Batteries are the only source of electricity used by battery-electric vehicles, or BEVs. The goal of LiDAR integration in BEVs is to support the development of autonomous driving technology in electric vehicles and offer improved safety features. LiDAR technologies help create safer and more effective electric vehicles by providing accurate mapping of the environment and object detection.

- By Application

Based on the application, the global automotive LiDAR market is categorized into semi-autonomous vehicles, autonomous vehicles. The semi-autonomous vehicles category leads the global automotive LiDAR market with the largest revenue share in 2023. Cars with advanced driver-assistance systems (ADAS) that can help drivers with specific activities but still need human intervention and supervision are referred to as semi-autonomous vehicles.

These cars', LiDAR technology helps with functions including collision avoidance systems, adaptive cruise control, and lane-keeping assistance. By offering precise environmental mapping and object recognition, LiDAR',s precise object detection and ranging capabilities help to improve safety and enable these semi-autonomous activities. Autonomous cars are built to function in specified situations or environments without the need for human involvement. In order to achieve increased levels of autonomy, LiDAR plays a crucial role in these vehicles by offering real-time 3D mapping, object identification, and navigation capabilities.

Automotive LiDAR Market Overview by Region

The global automotive LiDAR market is categorized into North America, Europe, Asia-Pacific, and the Rest of the World. North America emerged as the leading region, capturing the largest market share in 2023. The region',s significance is mainly due to the combination of significant investments, cutting-edge technological innovation, strong infrastructure, and a regulatory framework that is supportive.

The ecosystem in North America has created a favorable environment for LiDAR system research, development, and deployment because of the presence of significant automakers, tech behemoths, and top developers of LiDAR technology. The growth of LiDAR technology has been hastened through partnerships and collaborations between established companies and startups, which has led to its integration into a range of automotive applications. Furthermore, strong gove ment backing and advantageous regulatory frameworks are the results of North America',s dedication to promoting safety breakthroughs and autonomous car technology.

This support has prompted widespread testing and application of LiDAR-equipped cars, thereby strengthening the region',s position as a leader in this field. Furthermore, a strong infrastructure supporting technological adoption and a high customer desire for cutting-edge safety features and autonomous driving capabilities support the market',s growth in North America. North America is at the forefront of the automotive LiDAR industry thanks to this demand, which fuels continued investment and research in LiDAR technology. Together, these elements innovation centers, laws that encourage innovation, industry partnerships, consumer demand, and technological infrastructure have thrust North America to the forefront and made it a premier location for the development, application, and innovation of automotive LiDAR.

Automotive LiDAR Market Competitive Landscape

In the global automotive LiDAR market, a few major players exert significant market dominance and have established a strong regional presence. These leading companies remain committed to continuous research and development endeavors and actively engage in strategic growth initiatives, including product development, launches, joint ventures, and partnerships. By pursuing these strategies, these companies aim to strengthen their market position, expand their customer base, and capture a substantial share of the market.

Some of the prominent players in the global automotive LiDAR market include,

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- Velodyne LiDAR, Inc.

- Luminar Technologies, Inc.

- Innoviz Technologies

- Hesai Group

- RoboSense

- Ouster, Inc.

- Quanergy Systems, Inc.

- LeddarTech

- Valeo

Automotive LiDAR Market Recent Developments

- In June 2023, To deploy autonomous, zero-emission delivery vehicles using InnovizOne LiDAR, Innoviz and LOXO are expanding their partnership. With the use of Innoviz',s automotive-grade LiDAR, InnovizOne, LOXO',s zero-emission autonomous delivery vehicles may be able to help merchants carry items from nearby distribution centers to final customers in an environmentally friendly and productive way.

- In April 2023, Komodo, a proprietary ASIC (Application-Specific Integrated Circuit) chip designed for processing lidar point clouds, was introduced by Cepton, Inc. Developed to optimize the company',s proprietary lidar architecture, Komodo is a highly integrated custom SoC (System on Chip) that lowers costs by replacing several off-the-shelf silicon devices while improving the quality of point cloud data.

- In November 2022, The RS-LiDAR-E1 (E1), the most recent solid-state LiDAR from RoboSense, was introduced. With its exclusive, in-house chips and flash technology platform, the E1 is a state-of-the-art 360°, field of view LiDAR. At its heart is a unique product platform that uses specially designed chips to enable area array transceiver technology.

- In January 2022, Luminar Technologies, Inc. and Mercedes-Benz Group AG have teamed. Mercedes intends to use this collaboration to incorporate Luminar',s Iris LiDAR into its next-generation platform-based automobiles. Enhancing safety features and enabling autonomous highway driving capabilities are the goals of this integration.

Automotive LiDAR Market Report Segmentation

| ATTRIBUTE | , , , , ,DETAILS |

| By Type |

|

| By Technology |

|

| By Image Type |

|

| By Vehicle Type |

|

| By Application |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

No FAQs available.

Report Details

- Published Date:Dec 24, 2023

- Format:PDF

- Language:English

- Delivery:Instant

Download Sample

Get a free sample report to preview the content and quality.