Autonomous Vehicle Market Research Report: By Level of Automation (Level 3, Level 4, Level 5), By Application (Civil, Robo Taxi, Ride Share, Ride Hail, Self-Driving Truck, Self-Driving Bus), By Component (Hardware, Software and Services), and Region (North America, Europe, Asia-Pacific, and Rest of the World) Global Industry Analysis, Size, Share, Growth, Trends, Regional Analysis, Competitor Analysis and Forecast 2024-2032.

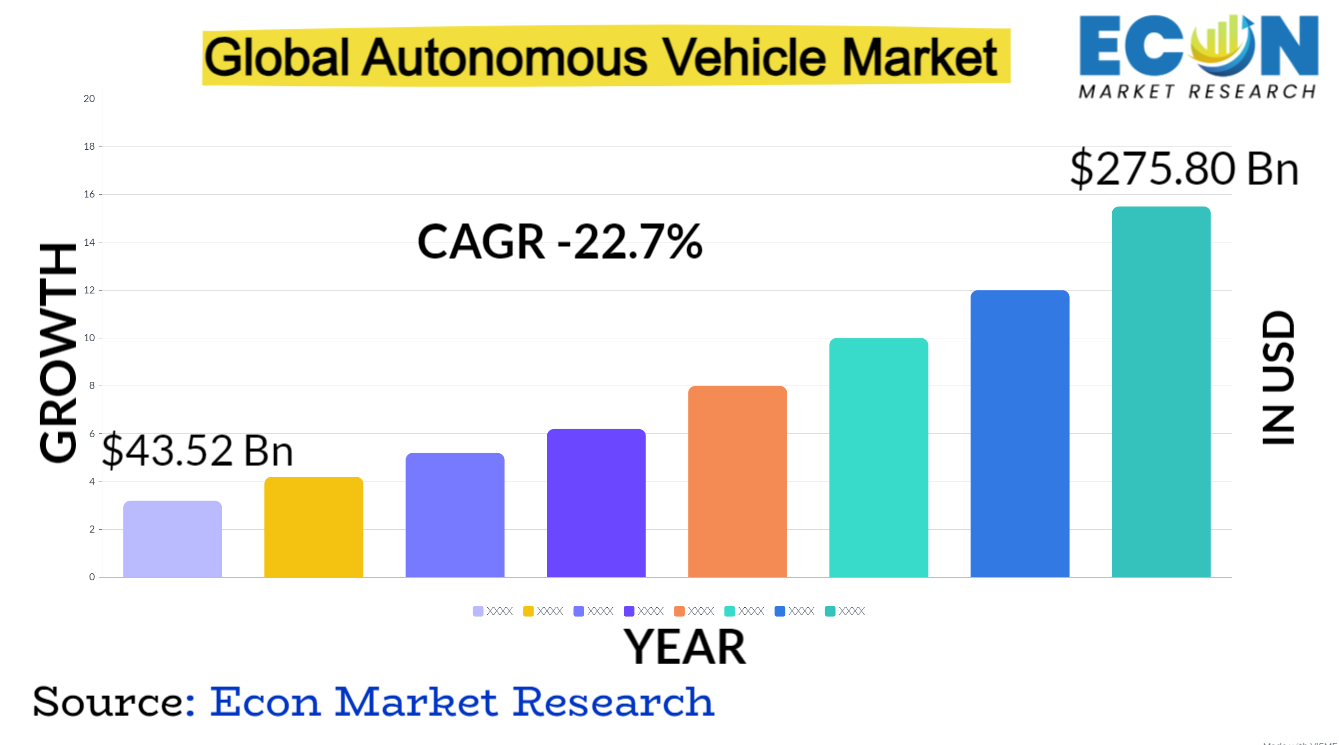

The Autonomous Vehicle Market was valued at USD 43.52 billion in 2023 and is estimated to reach approximately USD 275.80 billion by 2032, at a CAGR of 22.7% from 2024 to 2032.

Transportation is entering a transformational era with the introduction of autonomous vehicles. This innovative technology, which began to take shape in the early 2000s with prototype advancements by tech behemoths and automakers, sought to redefine mobility through the incorporation of advanced computing systems, artificial intelligence, and sensors into automobiles.

Early adoption was conservative, with few trials and feasibility and safety-focused experimental ventures. But when the technology advanced and showed that it might completely transform sectors, funding poured in, driving the market for autonomous vehicles forward. Automakers such as GM and Ford, along with startups like Tesla and Waymo, entered the market and shown different degrees of autonomy, ranging from partially driverless systems to assisted driving.

Obstacles included ethical issues, public acceptance, and regulatory conce s, however, advancements in sensor technology, machine lea ing, and infrastructural development hastened the process. By the middle of the 2010s, public testing and pilot programs had become more widespread, progressively influencing public opinion and opening the door for the incorporation of autonomous vehicles into regular transportation. With this introduction, a new age that would fundamentally alter urban planning, mobility, and transportation itself began.

| Report Attribute | Details |

| Estimated Market Value (2023) | 43.52 Bn |

| Projected Market Value (2032) | 275.80 Bn |

| Base Year | 2023 |

| Forecast Years | 2024 - 2032 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Level of Automation, By Application, By Component, &, Region |

| Segments Covered | By Level of Automation, By Application, By Component, &, Region |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2024 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa, and the Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Autonomous Vehicle Market Dynamics

The limits of autonomous driving are constantly being pushed by developments in data processing, sensor technology, and artificial intelligence. Businesses fight for the top spot, which leads to fierce rivalry and partnerships between tech companies, automakers, and startups. Research and development expenditures are heavily invested in, hastening the transition of semi-autonomous to fully autonomous systems. Gove ments all across the world navigate safety standards, liability difficulties, and infrastructure preparation through regulatory frameworks, which are crucial.

The market',s trajectory is shaped by policy modifications and pilot projects, which have an impact on industry participants', testing possibilities and market entry strategies. Market dynamics are also significantly impacted by consumer acceptance and trust. To encourage widespread usage, public awareness campaigns, safety demonstrations, and user experience enhancements are essential.

Pricing and market accessibility are influenced by economic variables, such as industrial economies of scale and cost reductions in sensor technology. Collaborations with logistics firms and ride-hailing services propel business applications and mold consumer demand. The constantly changing autonomous vehicle industry is shaped by the interaction of five factors: customer attitude, regulatory frameworks, technology innovation, and economic forces.

Autonomous Vehicle Market Drivers

- Technological Advancements

Advances in artificial intelligence, namely in the fields of machine lea ing and neural networks, have made it possible for cars to comprehend and react to intricate situations in real time. Advanced sensor technologies, such as LiDAR, radar, and cameras, provide enhanced perception skills that enable cars to recognize and traverse a variety of situations more precisely. Improvements in computing power enable quicker data processing and decision-making, which is essential for guaranteeing the effectiveness and safety of autonomous systems. Furthermore, the incorporation of cutting-edge connectivity options, such 5G networks, enables cars to interact with infrastructure and one another, improving navigation and general operational capabilities.

The capabilities of autonomous vehicles are greatly enhanced as a result of the convergence and maturation of various technologies, which also push the envelope in terms of safety, dependability, and speeding up the development of completely autonomous transportation systems. The industry',s continued rapid advancement, investment, regulatory framework development, and eventual transformation of the transportation landscape are all largely attributed to the unrelenting speed of technology innovation.

- Aging Population and Accessibility

,Globally, as a result of demographic changes, there are an increasing number of elderly people, necessitating the need for transportation options that meet their unique requirements. For elderly and other people with mobility issues, autonomous cars offer a safe and practical mobility choice. This is a potential answer. These cars can meet a variety of accessibility standards by providing amenities including simple access and departure, movable seats, and support for people with impairments or restricted movement. Furthermore, in underserved or distant places where access to conventional transportation may be limited, autonomous cars solve the issue of transportation availability.

Autonomous vehicles can help senior citizens stay independent by allowing them to go to important places, get medical care, and go to social events without having to rely on public transportation or traditional driving. For companies that create and provide services for autonomous vehicles, this shift in demographics offers a substantial business opportunity. In addition to meeting a social need, meeting the demands of an aging population encourages innovation in user interfaces, safety measures, and vehicle design, which eventually makes transportation more inclusive and accessible for all.

Restraints:

Substantial financial investments are necessary for the extensive research and development needed to construct advanced autonomous systems. Significant resources are needed for software development, computer infrastructure, and cutting-edge sensor technology. Moreover, extensive testing raises costs, particularly when it comes to guaranteeing dependability and safety. These expenses are additionally increased by the complexity of optimizing algorithms to manage uncertain real-world situations. There are financial difficulties in scaling up manufacturing to satisfy market needs while upholding high standards of quality.

The long-term cost burden is further increased by the requirement for ongoing upgrades and updates to stay up with the rapidly changing state of technology. Due to the entry hurdles created by these high development costs, innovation and market competitiveness are constrained. The autonomous vehicle market requires strategic planning, collaboration, and potential cost-reduction strategies to promote broader accessibility and affordability. This is because the industry',s reliance on ongoing technological breakthroughs drives up these prices.

- Regulatory Hurdles

There is a lack of consistency among jurisdictions and regions in the constantly changing legislation and policies conce ing infrastructure readiness, liability, and safety standards. Manufacturers and developers striving for uniform testing and deployment procedures face difficulties due to differing regulatory regimes. The legal complexity resulting from uncertainties regarding culpability in the event of accidents involving autonomous vehicles impede the advancement of the business. Furthermore, the rate of technical progress frequently surpasses the rate at which regulatory frameworks are developed, resulting in a delay in the adaptation of laws to new capacities and challenges.

One of the biggest challenges facing policymakers is continuing to strike a balance between protecting public safety and promoting innovation. , It is imperative that uniform laws address cybersecurity, safety, and moral issues while encouraging innovation and commercial expansion. Gove ments, industry players, and advocacy organizations must work together to create comprehensive, flexible, and uniform regulatory frameworks that support the responsible development of autonomous vehicle technology in order to overcome these regulatory obstacles.

Opportunities:

- Smart Cities Integration

The seamless integration of autonomous cars into urban environments, which would revolutionize transportation networks and urban planning, is made possible by smart city integration. Cities can improve overall mobility, lessen gridlock, and optimize traffic flow by integrating autonomous cars into smart city efforts. These cars can interact with smart infrastructure, such traffic lights and road sensors, thanks to their sophisticated sensors and connectivity, which makes for safer and more effective navigation. Furthermore, by lowering the dependency on private vehicles and alleviating urban traffic congestion, autonomous ridesharing and public transportation services may provide more adaptable, practical, and environmentally responsible mobility options.

Furthermore, autonomous vehicle data can be used by smart cities to plan infrastructure improvements, evaluate traffic patte s, and optimize transit routes. The goals of a smart city, which include efficiency, sustainability, and better quality of life, are all in line with this integration. To fully utilize autonomous cars inside smart city frameworks and create more livable, accessible, and sustainable urban settings, cooperation between city planners, technology developers, and transportation authorities is crucial.

- Integrating into Mobility-as-a-Service (MaaS)

People can access a network of linked mobility alte atives by integrating autonomous vehicles into MaaS platforms. This allows autonomous vehicles, ridesharing, and public transportation to be smoothly integrated into a single, user-centric system. This connection lessens the need for personal vehicles and eases urban traffic congestion by enabling optimal, customized, and on-demand mobility solutions. MaaS frameworks with autonomous cars provide efficient and adaptable travel experiences. Through mobile apps, users may plan complete trips involving a variety of smoothly connected means of transportation. To improve accessibility to public transportation hubs, autonomous shuttles or ride-hailing services, for example, could offer first- and last-mile connection.

Furthermore, by optimizing routes and resource use, MaaS platforms that deploy autonomous vehicles may save users money. In order to promote sustainability and lessen its impact on the environment, this model pushes people to switch from owning cars to mobility subscriptions or pay-per-use services. Realizing the full potential of MaaS with autonomous vehicles, improving urban mobility, lowering traffic congestion, and creating a more effective, sustainable, and user-friendly transportation ecosystem all depend on partnerships between IT companies, transportation providers, and local authorities.

Segment Overview

- By Level of Automation

Based on level of automation, the global autonomous vehicle market is divided into level 3, level 4, level 5. The level 5 category dominates the market with the largest revenue share in 2023. Level 5 represents the highest degree of autonomy, where vehicles can operate in all conditions and environments without human intervention. These vehicles are designed to perform all driving tasks, from navigating complex city streets to handling challenging weather conditions, without the need for human input. Level 5 vehicles lack traditional driving controls like steering wheels and pedals, as they are entirely self-driving and don',t require human oversight. Vehicles at Level 3 are capable of automated driving in certain conditions but still require human intervention and oversight.

The system manages most aspects of driving, such as acceleration, braking, and steering, in specific situations like highway driving. However, the driver must remain alert and be ready to take control when prompted by the system, particularly in complex or unpredictable scenarios. At Level 4, vehicles can operate autonomously in predefined or limited environments without human intervention. These vehicles can manage the entire driving task within specific geographic areas or under certain conditions, such as controlled city zones or highways. However, they might still have the option for a human driver to take over if necessary, but it',s not a requirement for normal operation.

- By Application

Based on the application, the global autonomous vehicle market is categorized into civil, robo taxi, ride share, ride hail, self-driving truck, self-driving bus. The self-driving truck category leads the global autonomous vehicle market with the largest revenue share in 2023. Autonomous trucks are designed for freight transportation and logistics, capable of operating without human intervention. These vehicles have applications in long-haul shipping, local delivery services, and logistics operations, aiming to increase efficiency and reduce human-related errors in transportation.

Autonomous buses operate without a human driver, providing public transportation services within predefined routes or areas. These vehicles cater to urban and suburban transit needs, offering environmentally friendly and efficient mass transit options. Civil autonomous vehicles category encompasses autonomous vehicles used for civilian purposes, including personal cars, minivans, and other vehicles designed for individual or family transportation. These vehicles are envisioned for everyday commuting, leisure travel, and general transportation needs.

Robo-taxis refer to autonomous vehicles deployed in taxi or ride-hailing services without human drivers. These vehicles can be hailed or summoned via an app, providing on-demand transportation services to passengers within a defined area or city. Ride-sharing involves autonomous vehicles utilized in shared transportation services where multiple passengers heading in similar directions share a vehicle. These services optimize routes and vehicle occupancy, reducing congestion and providing cost-effective transportation options. Similar to ride-share services, ride-hail autonomous vehicles operate on an on-demand basis, but they are hailed individually by passengers through apps or other means for point-to-point transportation.

- By Component

Based on component, the global autonomous vehicle market is segmented into hardware, software and services. The hardware segment dominates the autonomous vehicle market. This segment includes the physical components and equipment required for autonomous vehicles to function. It encompasses various sensors (such as LiDAR, radar, cameras), onboard computing systems (central processing units, GPUs), connectivity hardware (communication modules, antennas), and other tangible components like actuators, control systems, and vehicle platforms.

Hardware is crucial for gathering data, processing information, and executing actions necessary for autonomous driving. The software segment comprises the programming, algorithms, and operating systems that enable autonomous vehicles to perceive their environment, make decisions, and control their movements. This includes sensor fusion software that integrates data from multiple sensors, mapping and localization algorithms, artificial intelligence (AI) and machine lea ing for decision-making, and safety-critical software responsible for managing vehicle functions.

Software development is essential for ensuring the vehicle',s perception, navigation, decision-making, and control systems operate effectively and safely. Services segment involves the various ancillary offerings and support systems around autonomous vehicles. It encompasses a wide array of services, including but not limited to, data analytics, cybersecurity solutions, vehicle maintenance and repair, fleet management, mapping and geospatial services, remote monitoring and assistance, and customer support.

Autonomous Vehicle Market Overview by Region

The global autonomous vehicle market is categorized into North America, Europe, Asia-Pacific, and the Rest of the World. North America emerged as the leading region, capturing the largest market share in 2023. The area is home to a strong market for autonomous vehicles, significant investment, technological innovation, and favorable regulatory frameworks. A vibrant startup culture, major automakers, and tech behemoths have created a dynamic atmosphere that is conducive to innovation. large strides in autonomous car technology are being made by businesses with headquarters or large operations in North America, such as Waymo, Tesla, GM, and others.

Furthermore, the region has seen significant expenditures in R&,D, with gove ments, corporate investors, and venture capitalists funding projects involving autonomous vehicles. The rate of invention and commercialization of autonomous technology has increased as a result of these investments. Autonomous vehicle testing and deployment in controlled environments have been made easier by regulatory measures and pilot programs implemented in several states and provinces.

Initiatives in states like Michigan, Califo ia, and Arizona have played a key role in developing testing sites and establishing rules for the use of autonomous vehicles. North America',s leadership in autonomous vehicles is also a result of its consumers', acceptance of new technology and their preparation for the market. The infrastructure of the area, which consists of cutting-edge communication networks and encouraging laws, further establishes the region',s leadership in influencing the direction of autonomous vehicles.

Autonomous Vehicle Market Competitive Landscape

In the global autonomous vehicle market, a few major players exert significant market dominance and have established a strong regional presence. These leading companies remain committed to continuous research and development endeavors and actively engage in strategic growth initiatives, including product development, launches, joint ventures, and partnerships. By pursuing these strategies, these companies aim to strengthen their market position, expand their customer base, and capture a substantial share of the market.

Some of the prominent players in the global autonomous vehicle market include AB Volvo, Bayerische Motoren Werke AG, Ford Motor Company, General Motors, Hyundai Motor Group, Mercedes-Benz AG, Renault SA, Tesla,Inc, Toyota Motor Corporation, Volkswagen Group, and various other key players.

Autonomous Vehicle Market Recent Developments

- In July 2023, ZF',s Monterrey, Nuevo Leon plant in Mexico started producing its advanced driver assist system (ADAS) technology. In a similar vein, Luminar, another business, has increased its footprint and plans to launch in Mexico in 2023. In the upcoming years, Mexico is expected to become an important center for the production of self-driving truck technology.

Autonomous Vehicle Market Report Segmentation

| ATTRIBUTE | DETAILS |

| By Level of Automation |

|

| By Application |

|

| By Component |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

No FAQs available.

Report Details

- Published Date:Dec 17, 2023

- Format:PDF

- Language:English

- Delivery:Instant

Download Sample

Get a free sample report to preview the content and quality.