Cloud Block Storage Market Research Report: By Storage Type (Locally-Attached, Network-Attached), By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud) and By Industry Vertical (Retail and Consumer Goods, Government and Public, IT Telecommunication, Manufacturing, BFSI, Healthcare and Life Sciences, Media and Entertainment, Others), and Region (North America, Europe, Asia-Pacific, and Rest of the World) Global Industry Analysis, Size, Share, Growth, Trends, Regional Analysis, Competitor Analysis and Forecast 2023-2031.

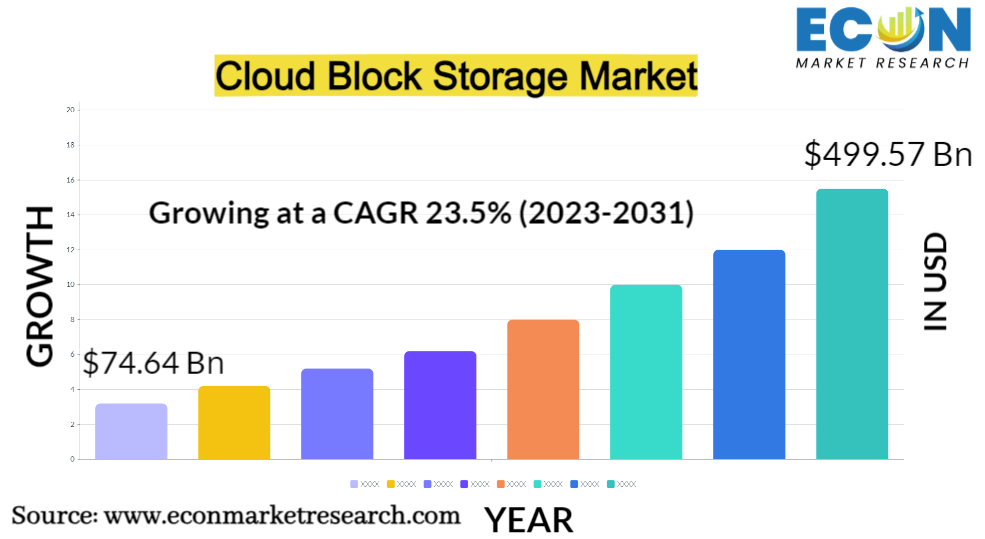

The Global Cloud Block Storage Market was valued at USD 74.64 billion in 2022 and is estimated to reach approximately USD 499.57 billion by 2031, at a CAGR of 23.5% from 2023 to 2031.

This industry, which provides scalable and high-performance storage solutions to both organizations and individuals, is an essential part of cloud computing services. Cloud block storage, in contrast to conventional on-premises storage, gives customers the freedom to distribute and manage storage resources as needed without the requirement for actual infrastructure. The capacity to store data in distinct blocks is one of the distinguishing characteristics of cloud block storage, which makes it perfect for a variety of applications, including database management, virtual machines, and data analytics. These block-level storage solutions provide high availability and data integrity protection with options for redundancy and replication.

The cloud block storage market has experienced fierce rivalry as the use of cloud computing keeps growing, with major competitors like amazon web services (AWS), microsoft azure, and google cloud offering cutting-edge storage options. Due to the intense competition, end users now enjoy cheaper costs and better performance, which has led to widespread adoption across numerous industries. In conclusion, the cloud block storage market has evolved into a crucial component of contemporary IT infrastructure, enabling companies to expand and effectively manage their data storage requirements in the always changing digital environment.

CLOUD BLOCK STORAGE MARKET: REPORT SCOPE &, SEGMENTATION

| Report Attribute | Details |

| Estimated Market Value (2022) | 74.64 Bn |

| Projected Market Value (2031) | 499.57 Bn |

| Base Year | 2022 |

| Forecast Years | 2023 - 2031 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Storage Type, By Deployment Mode, By Industry Vertical, &, Region |

| Segments Covered | By Storage Type, By Deployment Mode, By Industry Vertical, &, Region |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2031 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa, and the Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Cloud Block Storage Market Dynamics

Due to the rising acceptance of cloud computing by companies of all sizes, the market has expanded quickly. The demand for scalable and adaptable storage solutions that can handle the exponential growth of digital data is what is causing this growth. Major cloud service providers like amazon web services (AWS), microsoft azure, and google cloud are now more competitive than ever. In order to meet the varied client needs, this rivalry has led to aggressive pricing strategies, ongoing innovation, and a wide range of storage products.

Many businesses are implementing hybrid and multi-cloud strategies, which call for cloud block storage solutions that can run and integrate seamlessly across various on-premises and cloud platforms. Encryption, access restrictions, and regulatory compliance features in cloud block storage products are receiving more attention as a result of worries about data security and compliance.

The performance and responsiveness of cloud block storage have substantially increased because to advancements in storage technology, including the adoption of solid state drives (SSDs) and non-volatile memory express (NVMe), making it possible for it to run high-performance workloads. Utilizing features like tiered storage, data deduplication, and data lifecycle management can help users reduce the cost of their storage. With the integration of cloud block storage with data analytics and artificial intelligence (AI) capabilities, businesses are now able to gain insightful information from their data.

Cloud Block Storage Market Drivers

- Growing Adoption of Cloud Computing

Cost effectiveness is a key motivator. Cloud computing minimizes operational costs related to maintenance and upgrades by eliminating the need for significant upfront expenditures in physical infrastructure. This cost-effectiveness democratizes access to technology by enabling businesses of all sizes to use powerful computing capabilities without having to pay excessive costs. Scalability is another important consideration. With the use of cloud services, computer resources may be quickly scaled up or down to meet demand. This flexibility is essential in the dynamic business world of today, when shifts in workload and data needs are typical. Without the limitations of conventional IT infrastructure, businesses can increase their operations without any difficulty. Additionally, the accessibility of cloud services around the globe encourages remote work and collaboration, which boosts productivity and innovation. Cloud computing also offers robust security measures, making it an attractive choice for data storage and processing, allaying conce s about data breaches and loss.

- Data Explosion and Big Data Analytics

Several factors, including social media, Inte et of Things (IoT) devices, online sales, sensors, and more, are driving this increase in data collection. As a result of the data explosion, huge, intricate databases are now known as big data.Big data is distinguished by its quantity, speed, variety, and authenticity. The discipline of big data analytics has evolved as a crucial part of contemporary data-driven decision-making in reaction to the data explosion.

Big data analytics uses cutting-edge tools and methods to examine, interpret, and draw important conclusions from enormous and varied information. Data mining, machine lea ing, natural language processing, and predictive analytics are just a few of the techniques it includes. Businesses in all sectors use big data analytics to acquire a competitive edge. , They use it to uncover hidden patte s, trends, and correlations within their data, which can inform strategic decisions, optimize operations, improve customer experiences, and drive innovation.

Restraints:

- Data Security Conce s

Organizations are naturally wary about using cloud-based storage solutions to store their sensitive and important data in a time when data breaches and counterattacks are becoming more frequent and sophisticated. Businesses run a significant risk of suffering financial losses, reputational harm, and legal penalties if there is a chance of unauthorized access, data leaks, or loss. The security environment becomes more difficult due to compliance with data protection laws like the Health Insurance Portability and Accountability Act (HIPAA) and the General Data Protection Regulation (GDPR). To ensure that the data kept on their platforms conforms with these criteria, cloud block storage companies must traverse a complex web of laws. Severe penalties may be imposed for failure to comply.

- Compliance and Regulatory Hurdles

It can be difficult and time-consuming to ensure compliance when using cloud block storage solutions because numerous industries are subject to a variety of strict data protection and privacy standards. One of the most known instances is the General Data Protection Regulation (GDPR) in the European Union, which imposes stringent guidelines on the processing and storage of personal data. The GDPR',s principles of data minimization, purpose limitation, and the right to be forgotten must be followed by organizations storing data in cloud block storage systems. The protection of people',s privacy rights and the avoidance of harsh financial penalties make it essential to ensure compliance with GDPR and comparable laws.Furthermore, industry-specific regulations like the Health Insurance Portability and Accountability Act (HIPAA) in healthcare or the Payment Card Industry Data Security Standard (PCI DSS) in financial services impose additional compliance complexities.

Opportunities:

- Hybrid and Multi-Cloud Strategies

The cloud block storage market has a sizable opportunity due to the development of hybrid and multi-cloud methods. In order to maximize their IT operations, many businesses are realizing the benefits of combining cloud services from several vendors or even combining cloud and on-premises infrastructure. With this tactic, they are able to take use of the distinct advantages offered by each cloud provider, including AWS, Azure, and Google Cloud, while avoiding vendor lock-in and boosting resiliency. This trend presents opportunity for cloud block storage vendors to provide interoperable solutions that easily interface with diverse cloud environments. For firms pursuing hybrid and multi-cloud strategies, compatibility and simplicity of data mobility between various cloud platforms become key factors to take into account. Additionally, as organizations embrace a multi-cloud approach, they often require centralized management tools and services to monitor, allocate, and optimize their storage resources efficiently across different cloud providers

- Proliferation of Edge Computing

The concept of edge computing involves processing and analyzing data more closely in relation to the source of generation, which could be IoT devices, sensors, or local servers. This method enables real-time decision-making while reducing latency and bandwidth utilization, making it perfect for applications like autonomous vehicles, smart cities, and industrial automation. By offering dependable and scalable storage solutions for data generated at the edge, cloud block storage plays a crucial role in assisting edge computing projects. Edge devices need a robust storage infrastructure to store and handle the enormous volumes of data they generate and gather. Block storage in the cloud may easily connect with edge computing ecosystems, providing a centralized location for data produced at the edge. Moreover, cloud block storage facilitates data aggregation and synchronization between edge devices and central cloud data centers, ensuring that valuable insights from edge data are readily available for analysis and decision-making.

Segment Overview

- By Storage Type

Based on storage type, the global cloud block storage market is divided into locally-attached, network-attached. The network-attached category dominates the market with the largest revenue share. Network-attached storage (NAS) represents a centralized storage system that is connected to a network and can be accessed by multiple devices over that network. NAS solutions are highly scalable and can serve a wide range of users and applications simultaneously. They are well-suited for scenarios where data sharing, collaboration, and remote access are essential, such as in enterprise environments.

NAS also provides robust data management features and can support various protocols, making it a versatile choice for organizations with diverse storage needs. Locally-attached storage refers to storage resources that are physically connected or attached to a specific computing device, such as a server or a personal computer. This type of storage typically involves the use of hard drives, solid-state drives (SSDs), or other storage media directly connected to the host device. Locally-attached storage offers low-latency access and can be suitable for applications where data access speed is critical.

- By Deployment Mode

Based on the deployment mode, the global cloud block storage market is categorized into public cloud, private cloud, hybrid cloud. The hybrid cloud category leads the global cloud block storage market with the largest revenue share.Hybrid cloud solutions combine elements of both public and private clouds. Organizations using a hybrid cloud approach can integrate their on-premises infrastructure with public or private cloud resources, including cloud block storage. This hybrid model provides flexibility, allowing businesses to optimize their storage strategy by utilizing public cloud resources for scalability and cost-effectiveness while retaining sensitive or critical data in a private cloud environment. ,

A private cloud deployment involves the creation of a dedicated and isolated cloud environment for a single organization. Cloud block storage resources are provisioned within this private infrastructure, either on-premises or hosted by a third-party provider. Private clouds offer enhanced control, security, and customization options, making them suitable for industries with strict compliance requirements or organizations that prioritize data privacy. In a public cloud deployment, cloud block storage resources are provided and managed by third-party cloud service providers and are made available to multiple organizations or individuals over the inte et. This model offers scalability, cost-efficiency, and ease of access, making it suitable for businesses with variable storage needs.

- By Industry Vertical

Based on industry vertical, the global cloud block storage market is segmented into retail and consumer goods, gove ment and public, IT telecommunication, manufacturing, BFSI, healthcare and life sciences, media and entertainment, and others. The BFSI segment dominates the cloud block storage market. Security and compliance are paramount in the BFSI sector. Cloud block storage supports the storage and management of sensitive financial data, transaction records, and customer information, while ensuring data integrity and regulatory compliance.

The manufacturing industry relies on cloud block storage for managing product designs, production data, and supply chain logistics. This sector benefits from scalable storage solutions to store and process data from sensors and IoT devices on the factory floor. In the IT and telecommunication sector, cloud block storage facilitates the storage of large volumes of data generated by networks and services. It plays a critical role in data center operations, hosting cloud-native applications, and supporting telecommunication infrastructure.Cloud block storage is crucial in healthcare for managing electronic health records (EHRs), medical imaging data, and health research. It enables secure data sharing among healthcare providers and researchers, facilitating better patient care and medical advancements.

The media and entertainment industry relies on cloud block storage for content distribution, streaming, and archiving. It provides a scalable infrastructure for storing large media files, supporting content delivery networks, and enabling collaborative content creation. The retail and consumer goods industry leverages cloud block storage for inventory management, supply chain optimization, and customer data analytics. Scalable and reliable storage solutions are essential for handling vast amounts of transnational data and ensuring seamless e-commerce operations.

Cloud Block Storage Market Overview by Region

The global cloud block storage market is categorized into North America, Europe, Asia-Pacific, and the Rest of the World. North America emerged as the leading region, capturing the largest market share in 2022. For a number of convincing reasons, North America has become the market leader for cloud block storage. The cloud computing industry and related technologies have experienced rapid adoption and expansion in this region, which includes the United States and Canada. ,

A mature and well developed cloud computing ecosystem can be found in North America. The headquarters of significant cloud service providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are located here. Cloud adoption and cloud block storage utilization have surged due to this concentration of cloud infrastructure providers. Cloud computing has been quickly adopted by North American businesses across a range of sectors, including manufacturing, healthcare, finance, and technology. They are aware of the advantages of cloud block storage',s scalability, affordability, and flexibility.With multiple startups and well-established digital organizations always pushing the limits of what cloud storage can provide, the area is a hotspot for technical innovation.

Advanced cloud block storage solutions have been developed as a result of this innovative culture. HIPAA (Health Insurance Portability and Accountability Act), which applies to the healthcare industry, as well as other financial restrictions, are among the severe data protection and privacy laws in North America. To fulfil these demands, cloud block storage companies have improved their security and compliance features. Finance, e-commerce, healthcare, and media are some of the data-intensive industries that are based in the area. To manage the enormous amounts of data generated by their operations, these industries rely extensively on cloud block storage.

Cloud Block Storage Market Competitive Landscape

In the global cloud block storage market, a few major players exert significant market dominance and have established a strong regional presence. These leading companies remain committed to continuous research and development endeavors and actively engage in strategic growth initiatives, including product development, launches, joint ventures, and partnerships. By pursuing these strategies, these companies aim to strengthen their market position, expand their customer base, and capture a substantial share of the market.

Some of the prominent players in the global cloud block storage market include Amazon Web Services, Rackspace, Microsoft Corporation, Google Inc., Hewlett Packard Enterprise Development LP, VMware, Inc., IBM Corporation, Red Hat, Inc., EMC Corporation, Huawei Technologies Co. Ltd, and various other key players.

Cloud Block Storage Market Recent Developments

- In August 2023, Azure Cloud Block Store is extended by Pure Storage to more affordable SSD instances. Premium SSD v2 Disc Storage instances are now supported by Pure Storage',s Azure Cloud Block Store, its FlashArray Purity operating environment in Microsoft',s cloud. For the Azure VMware Solution (AVS), this functionality isolates computation from storage to cut expenses.

Cloud Block Storage Market Report Segmentation

| ATTRIBUTE | DETAILS |

| By Storage Type |

|

| By Deployment Mode |

|

| By Industry Vertical |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

No FAQs available.

Report Details

- Published Date:Oct 4, 2023

- Format:PDF

- Language:English

- Delivery:Instant

Download Sample

Get a free sample report to preview the content and quality.