Contactless Biometrics Technology Market Research Report: By Component (Hardware, Software, Service), By Application (Face, Fingerprint, Hand Geometry, Iris, Voice, and Others), By End-Use (Consumer Electronics, Healthcare, BFSI, Travel & Tourism, Government), and Region (North America, Europe, Asia-Pacific, and Rest of the World) Global Industry Analysis, Size, Share, Growth, Trends, Regional Analysis, Competitor Analysis and Forecast 2024-2032.

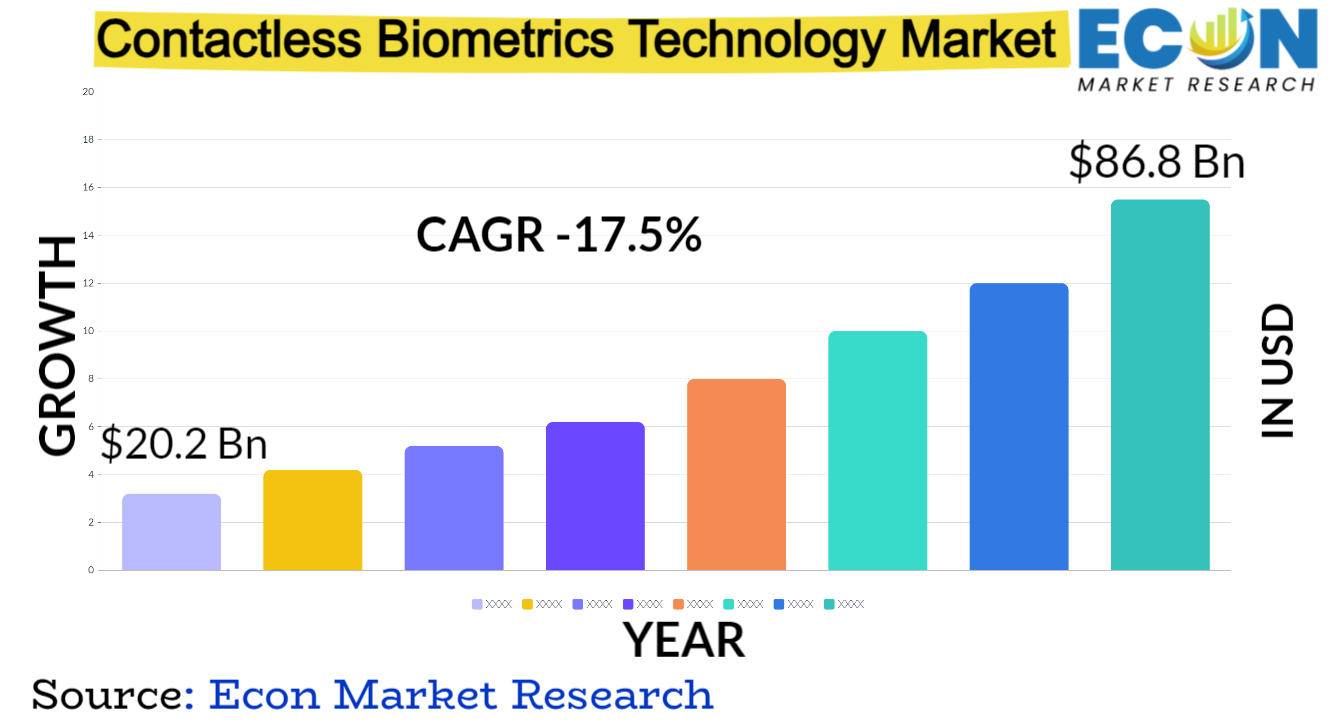

The Contactless Biometrics Technology Market was valued at USD 20.2 billion in 2023 and is estimated to reach approximately USD 86.8 billion by 2032, at a CAGR of 17.5% from 2024 to 2032.

Because contactless biometrics technology uses non-invasive techniques for identity verification, it has completely changed the landscape of security and identification. This state-of-the-art technology successfully authenticates people without physical touch by using distinctive biological attributes like fingerprints, face features, iris patte s, or even behavioral aspects like stride or typing rhythm. Because of its improved security, smooth user experience, and wide range of applications in the transportation, gove ment, healthcare, and financial sectors, contactless biometrics have seen exponential growth in the industry.

Its implementation in identity verification, payment authentication, and access control systems has greatly decreased fraud and improved security protocols all around. Because of the technology',s broad adoption and ability to provide convenience without sacrificing security, businesses are competing to produce more advanced and precise contactless biometric solutions, which has spurred innovation in the industry. Future contactless biometrics is expected to further transform identity authentication and security through ongoing advances in AI and machine lea ing.

CONTACTLESS BIOMETRICS TECHNOLOGY MARKET: REPORT SCOPE &, SEGMENTATION

| Report Attribute | Details |

| Estimated Market Value (2023) | 20.2 Bn |

| Projected Market Value (2032) | 86.8 Bn |

| Base Year | 2023 |

| Forecast Years | 2024 - 2032 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Component, By Application, By End-Use, &, Region |

| Segments Covered | By Component, By Application, By End-Use, &, Region |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2024 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa, and the Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Contactless Biometrics Technology Market Dynamics

A convergence of forces has caused dynamic movements in the market for contactless biometrics technology. At first, contactless biometrics was adopted as a more secure authentication method because to the rise in data breaches and security conce s. The COVID-19 epidemic served as a trigger, driving up demand for touchless solutions as hygienic conce s made conventional approaches like fingerprint scanning less appealing. In addition to increasing their use, this move toward contactless technology encouraged investment and innovation in the field. Furthermore, the market has expanded due to the growing range of applications across many industries, such as border control, healthcare, and payment authentication, in addition to access control.

The demand for strong identity verification systems in financial institutions and global gove ment initiatives to deploy biometric identification for citizen services have driven the market',s growth. The accuracy and effectiveness of contactless biometric systems have increased due to technological breakthroughs, especially in the fields of artificial intelligence and machine lea ing. This has made the systems more dependable and environment-adaptable. Furthermore, growing consumer consciousness regarding data privacy and laws like GDPR have made it necessary to design solutions that give security and privacy equal priority, which has an impact on market tactics and new product developments. Due to advancements in technology, changing consumer tastes, evolving regulatory environments, and an increasing number of applications across many industries, the market for contactless biometrics technology is still growing quickly.

Contactless Biometrics Technology Market Drivers

- Security Enhancement Demands

In a time of widespread identity theft, cyberattacks, and data breaches, conventional security methods have become progressively less effective. As such, there is a growing need to strengthen both physical and digital access points with stronger authentication mechanisms. Compared to conventional password- or token-based systems, contactless biometrics ensure a better level of security by using distinct biological indicators for identification. This makes them an appealing choice. Security measures are greatly strengthened by the irreplaceable nature of biological qualities like fingerprints, facial features, iris patte s, or behavioral peculiarities.

The ability of this technology to authenticate people using unique, hard-to-replicate characteristics has drawn interest from a variety of companies, particularly those that handle sensitive data or operate in high-security settings. The need for contactless biometrics keeps growing as organizations and companies place a higher priority on protecting sensitive information and preventing unwanted access, making it a key factor in the transformation of contemporary security paradigms.

- Increasing Gove ment Initiatives

Gove ments everywhere are realizing how important biometric identification is to enhancing security, expediting citizen services, and thwarting identity theft. Gove ments have been leading efforts to introduce biometric identification systems for passports, national IDs, border control, and social welfare programs as a means of improving national security measures. These programs seek to reduce identity-related crimes, strengthen authentication procedures, and guarantee the accuracy of official documentation. Furthermore, gove ments are using biometric technology in the public sector to expedite procedures, enable safe access to gove ment services, and effectively distribute rewards.

Gove ments are increasingly playing a major role in driving the adoption of biometric technology. By endorsing and implementing these systems, they create norms and precedents for other industries, which encourages the integration of contactless biometrics in fields outside of gove ment administration. In addition to strengthening security measures, the strategic alignment of gove ment goals with contactless biometrics is essential in creating a more efficient and safe digital environment for both individuals and companies.

Restraints:

- Privacy Conce s and Regulatory Hurdles

Conce s about potential breaches, misuse, and unauthorized access to sensitive data have increased as the usage of biometric data for authentication has grown. Strict guidelines for the collecting, storage, and use of biometric data are enforced by regional legislation around the world as well as by the General Data Protection Regulation (GDPR) in Europe. Strict steps must be taken to guarantee user permission, data security, and the anonymization or encryption of biometric data in order to comply with these regulations. It is still difficult to strike a balance between the requirement for increased security and the protection of individual privacy rights.

Furthermore, businesses using contactless biometrics operate in a dynamic environment where they must constantly adapt to comply with changing rules due to growing regulatory environments. In order to address these issues, significant investments in encryption technology, secure infrastructure, and strict data handling standards are required. These expenditures might increase implementation costs and operating complexity. Therefore, overcoming these legal and privacy issues becomes essential to the widespread adoption and effective use of contactless biometrics in a variety of sectors and legal contexts.

The implementation of biometric systems necessitates significant upfront costs for hardware procurement, software development, infrastructure integration, and frequently, specific staff training. The additional cost incurred is increased by the need to guarantee adherence to security and regulatory requirements. The total cost is increased by the need to purchase and maintain precise biometric sensors, complex algorithms, and safe databases. These initial expenses may operate as a deterrent for companies, particularly smaller ones or those with more constrained resources, making it more difficult for them to implement state-of-the-art biometric solutions. Moreover, there is a chance that the overall cost of ownership which takes into account future scalability, maintenance, and upgrades will rise dramatically over time.

Exorbitant upfront costs not only influence the viability of implementation but also have an impact on retu on investment estimates, which can impede adoption, especially in sectors with narrow profit margins. Reducing implementation costs by strategic planning, cost-effective solutions, and maybe cooperative efforts is necessary to mitigate these financial constraints and increase the accessibility of contactless biometrics in a variety of business environments.

Opportunities:

- Healthcare Integration

In order to provide proper medical record management and minimize errors related to manual identification, biometric authentication methods such as fingerprint, palm vein, or face recognition provide a safe and hygienic form of patient identification. Furthermore, contactless biometrics allow safe and easy authentication for virtual consultations and access to private medical data in a time when telemedicine and remote patient monitoring are priorities. In addition to identifying patients, these systems expedite access control to areas that are restricted within healthcare institutions, protecting critical equipment and medical supplies.

Furthermore, biometric technology improves medication management by guaranteeing precise administration and dispensing, which lowers the likelihood of mistakes. By offering a secure authentication mechanism compliant with HIPAA requirements, the incorporation of contactless biometrics further enhances compliance with strict healthcare data privacy regulations. In addition to enhancing patient safety and care quality, contactless biometrics in healthcare streamline operational processes and foster a safer, more secure healthcare environment.

- Expansion of Smart City Initiatives and The Inte et of Things (IoT)

In the context of cities adopting digital transformation, contactless biometrics provide an essential degree of ease and security. Biometric authentication can make it easier for people to securely access public areas, transit, and gove ment services in smart urban environments. For example, contactless biometrics can facilitate quick and safe admission to smart buildings, guaranteeing that only those with permission can enter. Personalized and context-aware services are made possible through integration with IoT devices, improving the citizen experience.

Furthermore, biometric authentication can optimize passenger flow in transportation hubs by facilitating easy access to public transportation, lowering traffic, and boosting security. Furthermore, contactless biometrics support the environmental sustainability of smart cities by eliminating the need for tangible tokens or paper-based verification, making cities greener overall. In addition to improving security and efficiency, the integration of contactless biometrics with smart city projects and the Inte et of Things paves the way for an urban environment that is more connected and focused on its citizens.

Segment Overview

- By Component

Based on component, the global contactless biometrics technology market is divided into hardware, software, service. The software category dominates the market with the largest revenue share in 2023. Software forms the core intelligence behind the functionality of contactless biometrics systems. It involves algorithms, databases, and applications that analyze, process, and match biometric data obtained from the hardware components. This software is responsible for identifying patte s, comparing captured biometric data with stored templates, and generating authentication results. Additionally, it includes user interfaces, system management tools, and encryption protocols that ensure the security and efficiency of biometric systems.

Hardware segment includes physical components essential for capturing, processing, and storing biometric data. It comprises devices such as fingerprint scanners, facial recognition cameras, iris scanners, palm vein readers, and other biometric sensors. These hardware components are responsible for capturing and converting biometric information into digital data, which is then processed by software for identification or authentication purposes.

The services segment encompasses various offerings related to the deployment, maintenance, and support of contactless biometrics technology. It includes installation, integration, and customization services for implementing biometric systems into existing infrastructure. Additionally, services may cover training, consulting, and technical support for businesses or organizations adopting contactless biometrics. Maintenance services, such as software updates, troubleshooting, and system upgrades, also fall under this category, ensuring the continuous and optimal functioning of biometric systems.

- By Application

Based on the application, the global contactless biometrics technology market is categorized into face, fingerprint, hand geometry, iris, voice, and others. The face category leads the global contactless biometrics technology market with the largest revenue share in 2023. Face recognition utilizes facial features to identify individuals. It analyzes unique facial patte s, contours, and features such as the distance between eyes, nose, and mouth to create a digital representation of a person',s face for authentication purposes. Fingerprint recognition is one of the oldest and most widely used biometric modalities. It identifies individuals based on unique patte s and ridges present on their fingertips.

Contactless fingerprint scanners capture and analyze these patte s without the need for physical contact.Hand geometry recognition assesses the shape and size of an individual',s hand as well as the lengths and widths of fingers for authentication. Contactless hand geometry systems use 3D imaging technology to create a unique handprint for identification. Iris recognition scans the unique patte s in the colored ring of tissue surrounding the pupil of the eye. It captures high-resolution images of the iris to create a template for authentication, offering highly accurate and contactless identification. Voice recognition identifies individuals based on their unique voice patte s and characteristics. Contactless voice biometrics analyze speech patte s, pitch, tone, and other vocal attributes for authentication purposes.

- By End-Use

Based on end-use, the global contactless biometrics technology market is segmented into consumer electronics, healthcare, BFSI, travel &, tourism, gove ment. The gove ment segment dominates the contactless biometrics technology market. Gove ments employ contactless biometrics for national identification programs, border security, e-gove ance services, and law enforcement. Biometric systems like facial recognition, iris scanning, or fingerprint identification aid in citizen authentication, ensuring secure access to gove ment services and enhancing national security measures.

In the consumer electronics sector, contactless biometrics are integrated into devices like smartphones, tablets, laptops, and smart home systems. They enable secure access to devices, authorize payments, and facilitate personalized user experiences through modalities like fingerprint sensors, facial recognition, or voice authentication. Within healthcare, contactless biometrics aid in patient identification, access control to sensitive medical records, and secure authentication for healthcare professionals. These technologies enhance security and accuracy in patient care, streamline administrative processes, and ensure compliance with data privacy regulations.

The BFSI sector extensively employs contactless biometrics for secure authentication in online banking, ATMs, and payment systems. Modalities such as fingerprint or iris recognition enhance security, reduce fraud, and provide a seamless user experience in financial transactions. In the travel and tourism industry, contactless biometrics streamline airport security, immigration processes, and hotel check-ins. These technologies enable efficient passenger identification at border control points, enhance airport security, and expedite traveler processing, reducing wait times.

Contactless Biometrics Technology Market Overview by Region

The global contactless biometrics technology market is categorized into North America, Europe, Asia-Pacific, and the Rest of the World. North America emerged as the leading region, capturing the largest market share in 2023. The area is home to several businesses that make significant investments in R&,D, creating a thriving ecosystem for technical innovation. This environment pushes the market forward by encouraging the development of innovative contactless biometric technologies. North America was among the first regions to use biometric technology, incorporating them into the gove ment, healthcare, and financial industries.

The established infrastructure in the area makes it easier to use contactless biometrics in a variety of applications. Security and privacy are guaranteed by the region',s clearly established regulatory frameworks and standards controlling the use of biometric data. Respecting these rules builds confidence and promotes the use of contactless biometric technologies.

Major industry participants and digital behemoths actively engaged in the creation and application of contactless biometrics are based in North America. Their resources, market power, and industrial knowledge propel the region',s leadership. In order to improve security, productivity, and user experience, contactless biometrics is becoming increasingly important in a number of North American businesses, including banking, healthcare, gove ment, and retail. The region',s expansion and market leadership in contactless biometrics technologies are fueled by this broad demand.

Contactless Biometrics Technology Market Competitive Landscape

In the global contactless biometrics technology market, a few major players exert significant market dominance and have established a strong regional presence. These leading companies remain committed to continuous research and development endeavors and actively engage in strategic growth initiatives, including product development, launches, joint ventures, and partnerships. By pursuing these strategies, these companies aim to strengthen their market position, expand their customer base, and capture a substantial share of the market.

Some of the prominent players in the global contactless biometrics technology market include Aware Inc., Fingerprint Cards AB, Fujitsu Limited, Gemalto N.V., HID Global, IDEMIA, M2SYS Technology, NEC Corporation, nViaSoft, Touchless Biometric Systems AG, and various other key players.

Contactless Biometrics Technology Market Recent Developments

- In September 2023, TECH5',s PAD and contactless fingerprint capture technology has been certified as compliant with iBeta ISO 30107-3.

- In June 2023, The acquisition of JENETRIC GmbH, a provider of biometric identity technology, has been agreed to by DERMALOG identity Systems GmbH, a manufacturer of face, iris, and fingerprint identification technology. Contactless fingerprint capture of superior quality is achieved with JENETRIC',s optical thin-film transistor (TFT) technology.

Contactless Biometrics Technology Market Report Segmentation

| ATTRIBUTE | , , , , DETAILS |

| By Component |

|

| By Application |

|

| By End-Use |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

No FAQs available.

Report Details

- Published Date:Dec 13, 2023

- Format:PDF

- Language:English

- Delivery:Instant

Download Sample

Get a free sample report to preview the content and quality.