Distributed Antenna System Market Research Report: By Coverage (Indoor and Outdoor), By Ownership (Carrier Ownership, Neutral-host Ownership, and Enterprise Ownership), By Type (Active DAS, Passive DAS, and Hybrid DAS), By Signal Source (Off-air Antennas, On-site Base Transceiver Station, and Small Cells), By Application (Airports & Transportation, Public Venues & Safety, Education Sector & Corporate Offices, Hospitality, Industrial, Healthcare, and Others), and Region (North America, Europe, Asia-Pacific, and Rest of the World) Global Industry Analysis, Size, Share, Growth, Trends, Regional Analysis, Competitor Analysis and Forecast 2023-2031.

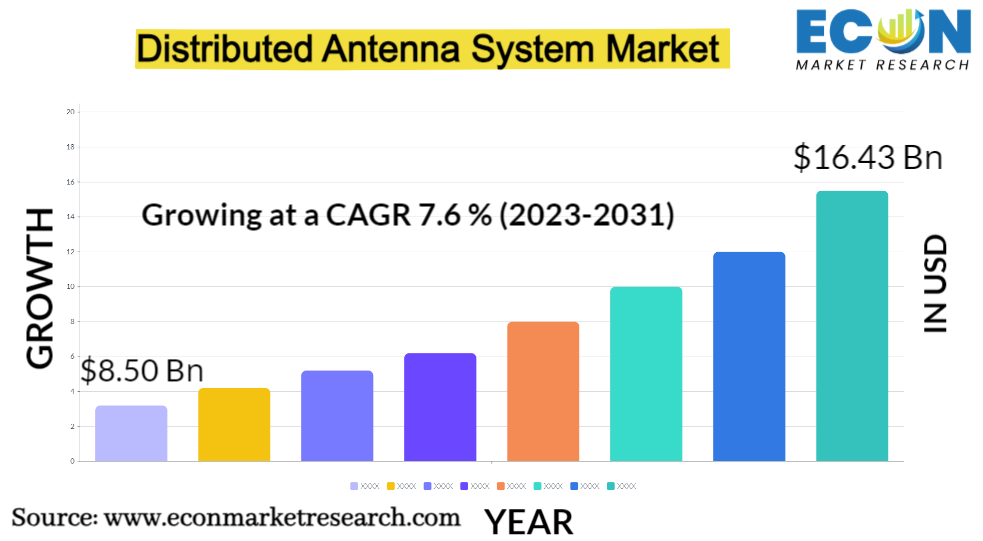

The Distributed Antenna System Market was valued at USD 8.50 billion in 2022, and is estimated to reach approximately USD 16.43 billion by 2031, at a CAGR of 7.6% from 2023 to 2031.

A distributed antenna system is a network of linked antennas strategically positioned within a defined region to improve wireless communication. It is intended to address signal coverage, capacity, and quality issues in big or heavily populated areas such as stadiums, airports, retail malls, and office buildings. DAS distributes a signal from a central source to several distant antennas connected by a network of fibre or coaxial wires. These antennas are distributed strategically around the region to provide consistent coverage and effective signal transmission. DAS increases network speed, decreases congestion, and improves signal quality for end users by expanding the reach of wireless signals.

,

DISTRIBUTED ANTENNA SYSTEM MARKET: REPORT SCOPE &, SEGMENTATION

| Report Attribute | Details |

| Estimated Market Value (2022) | 8.50 Bn |

| Projected Market Value (2031) | 16.43 Bn |

| Base Year | 2022 |

| Forecast Years | 2023 - 2031 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Coverage, By Ownership, By Type, By Signal Source, By Application, &, Region |

| Segments Covered | By Coverage, By Ownership, By Type, By Signal Source, By Application, &, Region |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2031 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa, and Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Distributed Antenna System Market Dynamics

The growing need for high-speed data access and seamless wireless communication in busy public venues such as airports, stadiums, and shopping malls. The rising popularity of smartphones and other wireless devices has increased the demand for improved network coverage and capacity. Furthermore, regulatory regulations and recommendations for dependable wireless communication in critical infrastructure sectors such as healthcare and public safety are pushing the market. Overall, the DAS market is growing because of ,the demand for efficient and cost-effective solutions to solve signal interference and poor coverage in indoor areas.

Distributed Antenna System Market Drivers

- Growing Demand for High-Speed Data Transmission

The growing demand for high-speed data transmission refers to the increasing need for rapid and efficient transfer of data. This demand arises due to emerging technologies, such as 5G, IoT, and cloud computing, which require quick and seamless connectivity. To meet this demand, Distributed Antenna Systems (DAS) play a crucial role in providing enhanced wireless coverage and capacity, facilitating high-speed data transmission.

Restraints:

- High Installation and Maintenance Costs

High installation and maintenance costs in the context of Distributed Antenna Systems (DAS) refer to the significant expenses associated with setting up and maintaining DAS infrastructure. These costs include equipment procurement, deployment, integration, and ongoing maintenance. The complex nature of DAS installations and the need for skilled technicians contribute to the higher expenses.

Opportunities:

- Increasing Demand in Public Venues and Enterprises

The increasing demand in public venues and enterprises refers to the growing need for robust wireless connectivity in locations such as stadiums, airports, shopping malls, and corporate environments. As consumers and employees rely heavily on mobile devices, there is a rising expectation for seamless connectivity. Distributed Antenna Systems (DAS) provide a scalable solution to enhance wireless coverage and capacity in these crowded areas, meeting the demand for reliable and high-performance wireless connectivity.

Segment Overview

- By Ownership Type

Based on the ownership type, the global distributed antenna system market is divided into carrier ownership, neutral-host ownership, and enterprise ownership. The neutral-host ownership category dominates the market with the largest revenue share of around 33.2% in 2022. The market for distributed antenna systems worldwide has seen the greatest market share held by the neutral-host ownership sector. The term ",neutral-host ownership", refers to DAS installations that are owned and run by neutral hosts, or independent third-party providers. These independent hosts make DAS infrastructure investments and then rent out network capacity to various wireless carriers and service providers. Multiple operators may use the same DAS infrastructure thanks to this ownership arrangement, which lowers costs and boosts productivity.

- By Application

Based on application, the global distributed antenna system market is divided into airports &, transportation, public venues &, safety, education sector &, corporate offices, hospitality, industrial, healthcare, and others. The public venues &, safety category is anticipated to grow at a higher CAGR of 7.2% during the forecast period. The need for dependable wireless communication and coverage is rising as more people are congregating in public spaces including stadiums, airports, retail malls, and conference centers. Distributed antenna solutions, which increase network capacity and guarantee smooth connectivity for a high number of users in such locations, provide an efficient response to this need.

- By Type

Based on the type, the global distributed antenna system market is divided into active DAS, passive DAS, and hybrid DAS. The passive DAS category is anticipated to grow at a higher CAGR of 7.5% during the forecast period. Passive DAS provides cost-effective options for improving wireless coverage and capacity in large interior spaces without the need of active components such as signal boosters. As a result, passive DAS is particularly appealing for usage in commercial buildings, colleges, and stadiums. Passive DAS systems are becoming more popular as the demand for dependable connection and smooth wireless communication in interior environments grows.

- By Signal Source

Based on signal source, the global distributed antenna system market is divided into off-air antennas, on-site base transceiver station, and small cells. The off-air antennas category is anticipated to grow at a higher CAGR of 7.4% during the forecast period, during the projection period, the off-air antennas category is expected to increase the most. This expansion can be ascribed to a variety of sources. The growing demand for over-the-air broadcasting services, such as television and radio, fuels the need for off-air antennas. The growing popularity of cord-cutting and streaming services has resulted in an increase in over-the-air TV reception, increasing demand for off-the-air antennas.

Distributed Antenna System Market Overview by Region

By Region, the market has been segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America had the largest revenue share, of around 32.8% in 2022. This growth is because the region has advanced technologically and has adopted wireless communication technology. The region is home to a huge number of large-scale commercial buildings, stadiums, and public events that require reliable wireless coverage, fueling demand for DAS systems. It has led the way in 5G rollout, with telecom companies investing extensively in infrastructure improvements. The necessity to support 5G networks', higher data capacity and enhanced network performance has accelerated DAS implementation in the region.

,

,

Distributed Antenna System Market Competitive Landscape

In the global distributed antenna system market, a ,few big players wield great market domination and have a strong regional presence. These significant players are devoted to continued research and development efforts. They also actively participate in strategic growth initiatives like as product creation, product launches, joint ventures, and partnerships. These organizations ,intend to pursue these tactics in order to increase their market position and develop their client base in order to acquire a significant portion of the market.

Some of the leading companies in the global distributed antenna system market include Advanced RF Technologies, Inc., ATC IP LLC, Betacom, Boingo Wireless, Inc., , HUBER+SUHNER, BTI Wireless, CenRF Communications Limited, Comba Telecom Systems Holdings Ltd., CommScope, Inc., Co ing Incorporated, Decypher, Fixtel Services, JMA Wireless, Symphony Technology Solutions, Inc., and various other key players.

Distributed Antenna System Market Recent Developments

- In June 2022, Comba telecom systems holdings limited has introduced an environmentally friendly integrated base station antenna (8TR) for 4G/5G networks, expanding their portfolio of tower top solutions and supporting their carbon neutrality goals. This latest addition to their portfolio not only meets coverage and capacity requirements but also positions itself as a notable tower-top antenna choice for 5G network rollout.

Distributed Antenna System Market Report Segmentation

| ATTRIBUTE | DETAILS |

| By Coverage |

, |

| By Ownership |

, |

| By Type |

, |

| By Signal Source |

|

| By Application |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

No FAQs available.

Report Details

- Published Date:Sep 19, 2023

- Format:PDF

- Language:English

- Delivery:Instant

Download Sample

Get a free sample report to preview the content and quality.