Gear Bicycle Market Report: By Gear Type (Single Speed and Multi-Speed), Bicycle Type (Road Bikes, Mountain Bikes, Hybrid Bikes, Commuter Bikes, Touring Bikes and Cyclocross Bikes), Distribution Channel (Offline and online), End-user (Men, Women and Children) Region (North America, Europe, Asia-Pacific, Latin America, Middle-East and Africa) Global Industry Analysis, Size, Share, Growth, Trends, Regional Analysis, Competitor Analysis and Forecast 2024-2032.

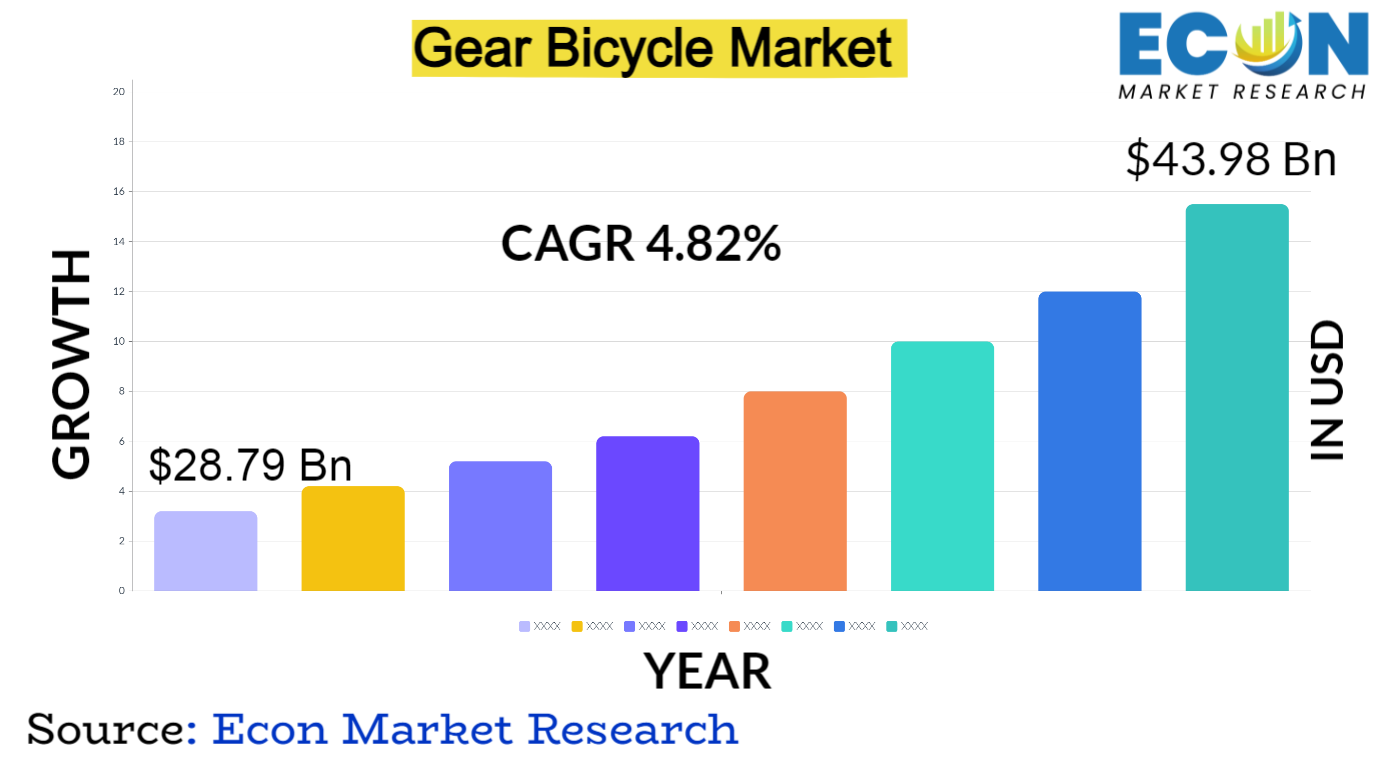

Global Gear Bicycle market is predicted to reach approximately USD 43.98 billion by 2032, at a CAGR of 4.82% from 2024 to 2032.

Gear bicycle bicycles are equipped with gear mechanisms, including derailleur or hub gears, enabling riders to adapt to various terrains, slopes, and riding conditions. The market has witnessed significant growth in recent years, driven by increasing urbanization, rising health and fitness consciousness, and the growing popularity of cycling as a sustainable mode of transportation. Additionally, technological advancements, such as the integration of electronic shifting systems and lightweight materials, have further propelled market expansion.

The gear bicycle market has grown significantly globally in recent years due to a number of important factors. Bicycles with gear systems are becoming more and more popular due to urbanisation trends, personal health conce s, and environmental sustainability. Cycling is becoming a more popular and environmentally friendly form of transportation for consumers, particularly in crowded cities with high levels of pollution and traffic jams. In addition, market expansion has been supported by the expansion of cycling events, fitness programmes, and gove ment-led initiatives supporting cycling infrastructure.

| Report Attribute | Details |

| Estimated Market Value (2023) | USD 28.79 billion |

| Projected Market Value (2032) | USD 43.98 billion |

| Base Year | 2023 |

| Forecast Years | 2024 &ndash, 2032 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- Based on By Gear Type, By Bicycle Type, By Distribution Channel, By End-User &, Region. |

| Segments Covered | By Gear Type, By Bicycle Type, By Distribution Channel, By End-User, &, By Region. |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2024 to 2032. |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa. |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others. |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Gear Bicycle Dynamics

The dynamics of the worldwide gear bicycle market are influenced by a number of variables that affect the industry',s supply and demand. Market dynamics are largely driven by shifting consumer preferences and lifestyle choices on the demand side. Gear bicycles are becoming more and more popular as a form of transportation and recreation as conce s about environmental sustainability and health and fitness increase.

Furthermore, the global trend of urbanisation and the growth of cycling infrastructure in cities have opened up new markets as more people look for non-conventional ways to get around crowded cities. Additionally, the emergence of digital marketing techniques and e-commerce platforms has improved market accessibility, allowing producers and merchants to reach a wider audience and profit from new trends. ,On the supply side, technological advancements and innovations continue to reshape the landscape of the gear bicycle market.

Manufacturers are investing in research and development to improve the performance, durability, and design of gear systems, as well as integrate smart features and connectivity options to enhance the riding experience. Furthermore, strategic partnerships and collaborations between industry players, as well as mergers and acquisitions, are reshaping the competitive landscape and driving consolidation within the market. Regulatory initiatives and standards related to safety, environmental sustainability, and product quality also influence market dynamics, shaping manufacturers', strategies and product offerings. Overall, the global gear bicycle market is characterized by dynamic and evolving trends, driven by shifting consumer preferences, technological advancements, and regulatory.

Gear Bicycle Drivers

- Health and Fitness Consciousness

Gear bicycle demand is rising as people look for more environmentally friendly ways to travel and become more health conscious. Cycling provides a host of health advantages, such as stress relief, weight management, and cardiovascular exercise. A growing number of people are tu ing to cycling as a practical and pleasurable way to stay active and enhance their general well-being in light of growing conce s about sedentary lifestyles and the prevalence of chronic diseases. The use of gear bicycles is increasing due to this trend, especially among urban residents searching for environmentally friendly ways to commute and recreational cyclists looking for outdoor exercise opportunities.

- Technological Advancements

The market is expanding due to the constant innovation in bicycle design and gear technology, which improves riders', comfort, convenience, and performance. In order to provide lighter materials, electronic shifting systems, and sophisticated gear mechanisms that provide smoother gear changes and increased efficiency, manufacturers are spending money on research and development.

The integration of intelligent features like GPS navigation, fitness tracking, and mobile device connectivity is made possible by technological advancements, which improve the overall riding experience. Technological innovations are critical in propelling sales and expanding market opportunities as consumers seek out more sophisticated and user-friendly gear bicycles.

Restraints:

- High Cost of Gear Bicycle

The initial cost of purchasing a gear bicycle can be prohibitive for some consumers, especially in regions where disposable incomes are relatively low. Gear bicycles typically command higher price points compared to conventional bicycles, primarily due to the added complexity of gear systems and advanced components. As a result, price sensitivity among consumers may limit market penetration, particularly in emerging economies where affordability is a key consideration for purchasing decisions. Manufacturers and retailers need to address this challenge by offering competitive pricing strategies, financing options, and entry-level models to attract a broader customer base.

- Limited Cycling Infrastructure

Inadequate cycling infrastructure, including bike lanes, dedicated pathways, and secure parking facilities, poses a significant barrier to market growth in many regions. Without proper infrastructure support, cyclists may face safety conce s, traffic congestion, and limited access to key destinations, discouraging them from using gear bicycles for commuting and recreational purposes. Gove ment initiatives and urban planning efforts are essential to address these infrastructure gaps and promote cycling as a viable transportation option. However, the lack of funding, competing priorities, and bureaucratic hurdles often hinder the development of comprehensive cycling infrastructure networks, limiting market opportunities for gear bicycle manufacturers and retailers.

Opportunities:

- Rise of Electric Gear Bicycles

The advent of electric gear bicycles offers a substantial chance for market growth. With the help of electric-assist technology, cyclists can pedal more efficiently and thus reach a broader audience, including older adults and people with mobility impairments. With the help of electric power assistance and gear systems, electric gear bicycles allow riders to easily navigate longer distances and difficult terrain.

Electric gear bicycle demand is predicted to soar as consumers seek out environmentally friendly substitutes for conventional modes of transportation and embrace electric mobility solutions more and more. Producers can take advantage of this trend by creating cutting-edge electric gear bicycle models that satisfy a range of consumer demands and lifestyle preferences.

Segment Overview

- By Gear Type

By gear type, bicycles are classified into single-speed and multi-speed categories. Single-speed bicycles feature a simple gear mechanism ideal for flat terrain and urban commuting, offering low maintenance and ease of use. On the other hand, multi-speed bicycles are equipped with gear systems that allow riders to adjust speed and resistance, making them suitable for diverse riding conditions, including hilly terrain and off-road trails.

- By Bicycle type

Bicycle type segmentation categorizes gear bicycles into distinct categories tailored to different riding preferences and purposes. Road bikes are designed for speed and efficiency on paved roads, featuring lightweight frames and narrow tires for optimal performance. Mountain bikes are built to handle rugged off-road trails and challenging terrain, equipped with suspension systems and durable components for enhanced stability and control.

Hybrid bikes combine features of road and mountain bikes, offering versatility for commuting, fitness riding, and leisure cycling. Commuter bikes prioritize comfort and practicality for urban commuting, with features such as fenders, racks, and lights for everyday use. Touring bikes are designed for long-distance travel and loaded touring, featuring robust frames and gear systems capable of carrying heavy loads. Cyclocross bikes are versatile options suited for both on-road and off-road riding, featuring wider tires and clearance for mud and debris.

- By Distribution Channel

Gear bicycles are distributed through both physical retail locations and inte et retail platforms. Brick-and-mortar stores, specialty bicycle shops, and department stores are examples of offline retail. They offer customers in-person shopping experiences and individualised support from staff members who possess extensive knowledge. Customers can browse, compare, and buy gear bicycles from the comfort of their homes with options for doorstep delivery and hassle-free retu s through online retail channels, which provide accessibility and convenience.

- By End-User

End-user segmentation considers the diverse demographics of gear bicycle consumers, including men, women, and children. Gear bicycles are designed with ergonomic considerations and size options tailored to the specific needs and preferences of each demographic group, ensuring a comfortable and enjoyable riding experience for riders of all ages and gender.

Gear Bicycle Overview by Region

In North America, the market is driven by a strong culture of recreational cycling, supported by extensive cycling infrastructure in urban centers and a growing emphasis on active lifestyles. The region also benefits from a robust retail landscape, with a wide array of specialty bicycle shops, online retailers, and outdoor recreation outlets catering to diverse consumer preferences.

Europe stands out as a mature market for gear bicycles, with a long tradition of cycling as a mode of transportation and leisure activity. Countries like the Netherlands and Denmark have well-developed cycling infrastructure and high rates of bicycle ownership, fostering a conducive environment for market growth. Moreover, stringent environmental regulations and gove ment initiatives promoting sustainable transportation further drive demand for gear bicycles across the continent.

In the Asia-Pacific region, rapid urbanization, population growth, and rising disposable incomes are fuelling demand for gear bicycles as affordable and eco-friendly transportation solutions. Countries like China and India are witnessing a surge in bicycle sales, driven by increasing traffic congestion, air pollution conce s, and health-conscious consumer trends. Moreover, gove ment investments in cycling infrastructure and initiatives to promote active transportation are creating opportunities for market expansion in the region.

Gear Bicycle Market Competitive Landscape

Major manufacturers such as Giant Manufacturing Co., Ltd., Trek Bicycle Corporation, and Specialized Bicycle Components, Inc. dominate the market with a wide range of gear bicycle offerings catering to various riding preferences and demographics. These industry leaders invest heavily in research and development to introduce cutting-edge technologies, lightweight materials, and ergonomic designs that enhance performance and user experience.

Moreover, strategic partnerships with professional cycling teams, sponsorship of cycling events, and celebrity endorsements help strengthen brand visibility and credibility, driving consumer loyalty and market share. Alongside established players, a diverse ecosystem of niche brands, boutique manufacturers, and start-ups contribute to market competitiveness by offering specialized gear bicycles tailored to specific riding disciplines, customization options, and lifestyle aesthetics. ,

E-commerce platforms and online marketplaces have also democratized market access, enabling emerging brands to reach global audiences and compete on a level playing field with established incumbents. Distribution channels play a pivotal role in shaping the competitive landscape, with offline retailers, specialty bike shops, and online retailers vying for market share and customer loyalty through competitive pricing, promotions, and value-added services.

Gear Bicycle Market Leading Companies:

-

Giant Manufacturing Co. Ltd.

-

Trek Bicycle Corporation

-

Specialized Bicycle Components, Inc.

-

Merida Industry Co., Ltd.

-

Scott Sports SA

-

Accell Group N.V.

-

Cannondale Bicycle Corporation

-

Colnago E esto &, C. S.r.l.

-

Kross S.A.

-

Hero Cycles Ltd.

Gear Bicycle Recent Developments

- Dec 2022, Classified Cycling, a pioneer in developing cutting-edge gear shifting technology for the bicycle industry, has successfully secured a funding round totalling 22 million euros. The investment, spearheaded by UK-based Active Partners, underscores the company',s commitment to advancing its product portfolio, especially in e-bikes, and forging strategic partnerships.

Global Gear Bicycle Report Segmentation

| ATTRIBUTE | , , , , DETAILS |

| By Gear Type |

|

| By Bicycle Type |

|

| Distribution Channel |

|

| End-User |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

No FAQs available.

Report Details

- Published Date:Feb 7, 2024

- Format:PDF

- Language:English

- Delivery:Instant

Download Sample

Get a free sample report to preview the content and quality.