Liquid Insulation Material Market Report: By Type (Mineral Insulating Oil, Synthetic Insulating Oil, Vegetable Oil and Silicone Oil), By Application (Electric, Motor, and Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle-East and Africa) Global Industry Analysis, Size, Share, Growth, Trends, Regional Analysis, Competitor Analysis and Forecast 2024-2032.

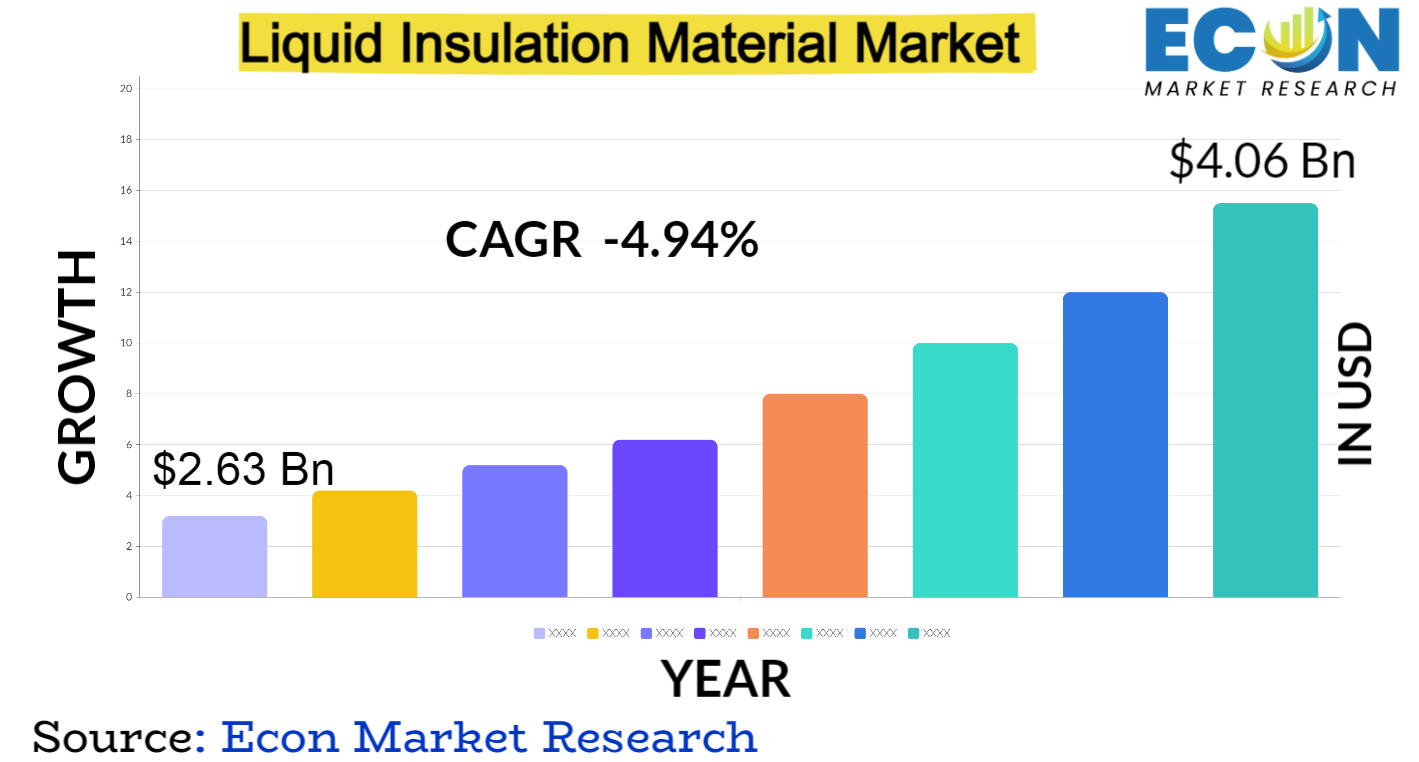

Global Liquid Insulation Material Market is predicted to reach approximately USD 4.06 billion by 2032, at a CAGR of 4.94% from 2024 to 2032.

Liquid insulation materials, sometimes referred to as insulating paints or coatings, are a cutting-edge category of goods that offer surfaces a seamless protective layer that resists corrosion and provides thermal insulation. These materials', remarkable insulating qualities are a result of their composition of ceramic microspheres and sophisticated polymers. Since liquid insulation materials are an affordable and adaptable substitute for conventional insulation techniques, they are widely used in a variety of industries, including electronics, automotive, aerospace, and construction.

Liquid Insulation Material Market Report Scope and Segmentation

| Report Attribute | Details |

| Estimated Market Value (2023) | USD 2.63 billion |

| Projected Market Value (2032) | USD 4.06 billion |

| Base Year | 2023 |

| Forecast Years | 2024 &ndash, 2032 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- Based on By Type, By Application, &, Region. |

| Segments Covered | By Type, By Application, &, By Region. |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2032. |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa. |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others. |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Liquid Insulation Material Dynamics

Global energy efficiency regulations and growing public awareness are major motivators for industries looking for cutting-edge insulation solutions. Because they offer seamless corrosion resistance and thermal protection, liquid insulation materials are becoming more and more popular in a variety of industries. The demand for these materials is particularly high in the construction sector because they provide a space-saving, lightweight substitute for conventional insulating techniques.

In this market, innovation and ongoing product development are critical factors that shape the dynamics. Producers are allocating significant resources towards research and development in order to launch formulas that not only improve insulation qualities but also address particular industry requirements. The utilisation of liquid insulation materials for heat dissipation management is being encouraged by the automotive industry',s growing emphasis on sustainability and fuel efficiency.

Liquid Insulation Material Drivers

- Energy Efficiency Regulations and Sustainability Initiatives ,

An important factor propelling the worldwide market for liquid insulation materials is the growing emphasis on sustainability and energy efficiency. Innovative insulation solutions are being adopted by industries due to stringent regulations and initiatives to reduce carbon footprints. A viable option for improving thermal efficiency in industrial processes, vehicles, and buildings is to use liquid insulation materials. The ability of liquid insulation materials to support environmental sustainability and energy conservation is expected to drive demand for these materials as gove ments around the world continue to tighten energy performance standards.

- Technological Advancements and Product Innovations

Innovations in liquid insulation materials and ongoing technological advancements are driving the market. In order to enhance these materials', performance attributes&mdash,such as increased heat conductivity, durability, and application ease&mdash,manufacturers are spending in R&,D. The market',s reach is further increased by the continuous efforts to develop bio-based liquid insulation materials, which are in line with consumers', increasing desire for environmentally friendly and sustainable solutions. Formulations that are innovative and tailored to industry needs&mdash,like those in the automotive and construction sectors&mdash,are important forces behind market dynamics and increased adoption in a variety of applications.

Restraints:

- Initial Cost and Implementation Challenges

The comparatively higher initial costs of these advanced materials are one of the main obstacles to the market for liquid insulation materials. Even though there will be significant long-term energy savings, the initial costs could be prohibitive, particularly for small businesses and cost-sensitive markets. Furthermore, the application of liquid insulation materials requires expertise, which may raise the project',s overall cost. Expanding market penetration requires removing these financial obstacles and attending to the requirement for specialised training.

- Limited Awareness and Market Penetration

Market expansion is hampered by a lack of knowledge about the uses and advantages of liquid insulation materials. It',s possible that many end users are unaware of the benefits these materials provide in terms of sustainability, corrosion resistance, and thermal insulation. To overcome this obstacle, raising awareness through focused marketing and educational programmes is crucial. Furthermore, it might take coordinated efforts to highlight the better performance and adaptability of liquid insulation materials in areas where there are well-established preferences for traditional insulation techniques in order to achieve market penetration in those areas.

Opportunities:

- Automotive Sector Embracing Sustainability

The growing emphasis on fuel economy and sustainability in the automotive industry presents liquid insulation materials with a bright future. The use of cutting-edge insulation solutions becomes essential as automakers work to lighten vehicles and increase energy efficiency. Because they are compact and lightweight, liquid insulation materials can help automobiles regulate their heat better. Developing customised solutions in partnership with automakers and taking part in the expanding electric vehicle market further expands the opportunities for growth in this industry.

Segment Overview

- By Type

The liquid insulation material market is segmented based on the type of insulation oil, encompassing mineral insulating oil, synthetic insulating oil, vegetable oil, and silicone oil. Mineral insulating oil, derived from petroleum, has been a traditional choice due to its good dielectric properties and cost-effectiveness. Synthetic insulating oil, on the other hand, is a result of advanced chemical processes, offering improved performance characteristics such as higher thermal stability and reduced environmental impact.

Vegetable oil, often sourced from renewable plant-based materials, represents a growing trend towards eco-friendly insulation options, appealing to industries emphasizing sustainability. Silicone oil, with its excellent electrical insulation properties and resistance to temperature extremes, is gaining traction as a high-performance alte ative in various applications. The diverse range of liquid insulation types caters to different industry needs, providing a spectrum of choices based on performance, environmental considerations, and specific use cases.

- By Application ,

The application segment of the liquid insulation material market encompasses electric, motor, and other uses. In the electric sector, these materials play a vital role in insulating electrical components, ensuring the safety and efficiency of power transmission and distribution systems. The motor application involves the use of liquid insulation materials to enhance the performance and reliability of electric motors, reducing heat dissipation and improving overall efficiency. The ",other", category encompasses a wide array of applications across industries, including but not limited to transformers, capacitors, and electronic devices.

The versatility of liquid insulation materials allows for their application in diverse settings, contributing to thermal management and preventing electrical breakdown. As industries continue to seek energy-efficient solutions, the adoption of liquid insulation materials across these varied applications is driven by the need for effective thermal protection, durability, and adherence to sustainability goals. The segmentation by application reflects the adaptability of liquid insulation materials to a broad spectrum of electrical and mechanical systems, positioning them as integral components in the pursuit of enhanced performance and energy efficiency across industries.

Liquid Insulation Material Overview by Region

North America has been a major player in the market thanks to its sophisticated infrastructure and emphasis on energy efficiency. Liquid insulation materials are becoming more widely used, particularly in the building and automotive industries, thanks to the region',s dedication to sustainable practices. Europe follows suit, with stricter environmental laws and a rising preference for environmentally friendly products helping to drive market growth. The market for liquid insulation materials is further driven by the European Union',s aggressive climate goals and emphasis on lowering carbon emissions, especially for materials made from renewable resources like vegetable oil.

In the Asia-Pacific region, rapid industrialization, urbanization, and the need for mode ized infrastructure are fuelling the market growth. Countries such as China and India are witnessing increased investments in construction and energy-efficient technologies, providing significant opportunities for liquid insulation material manufacturers. Additionally, the rising automotive production in the region, coupled with a growing awareness of sustainable practices, is boosting the adoption of these materials.

Liquid Insulation Material Market Competitive Landscape

The market is dominated by well-known corporations like Cargill, ABB, Hitachi, and JOOYN, which place a high priority on R&,D to bring innovative formulations and technologies. These leaders in the field concentrate on improving the performance attributes of liquid insulation materials, like increased heat conductivity, decreased environmental impact, and application versatility.

The market also witnesses the active participation of niche and emerging players, contributing to the overall competitiveness. These companies often specialize in specific types of liquid insulation materials or cater to niche applications within industries. The competitive dynamics are further intensified by collaborations and partnerships between manufacturers and end-users, aiming to develop customized solutions that meet specific industry requirements. Additionally, a growing trend in the market is the incorporation of bio-based liquid insulation materials, with companies like Cargill and Nynas AB leading the charge towards environmentally friendly alte atives.

Liquid Insulation Material Market Leading Companies:

-

Cargill, Incorporated

-

ABB Ltd.

-

Hitachi, Ltd.

-

3M Company

-

BASF SE

Liquid Insulation Material Recent Developments

- March 2023, Solvay, a prominent player in specialty materials on the global market, has unveiled a latest addition to its Xydar liquid crystal polymers (LCP) lineup. The newly introduced Xydar LCP G-330 HH grade is specifically crafted to fulfil stringent safety requirements in electric vehicle (EV) battery components. This advanced material is engineered to tackle demanding thermal and insulation needs, focusing particularly on battery module plates in EV models that utilize higher voltage systems.

- June 2023, DuPont and JetCool Technologies Inc. (JetCool) have joined forces in a strategic collaboration aimed at promoting the widespread adoption of cutting-edge liquid cooling technology. This collaboration seeks to enhance thermal management in various high-performance computing applications, including semiconductors and data centers. Through this partnership, DuPont and JetCool plan to establish a novel sales channel, facilitating the introduction of JetCool',s innovative cooling solutions to semiconductor companies based in Taiwan and Singapore.

,

Global Liquid Insulation Material ,Market Report Segmentation

| ATTRIBUTE | , , , , ,DETAILS |

| By Type , |

|

| By Application |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

No FAQs available.

Report Details

- Published Date:Jan 24, 2024

- Format:PDF

- Language:English

- Delivery:Instant

Download Sample

Get a free sample report to preview the content and quality.