Pediatric Medical Devices Market Report: By Product (Cardiology Devices, In Vitro Diagnostic (IVD) Devices, Diagnostic Imaging Devices, Anesthesia & Respiratory Care Devices, Neonatal ICU Devices and Others) By End-user (Hospitals, Pediatric Clinics, Ambulatory Surgical Centers and Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle-East and Africa) Global Industry Analysis, Size, Share, Growth, Trends, Regional Analysis, Competitor Analysis and Forecast 2023-2031.

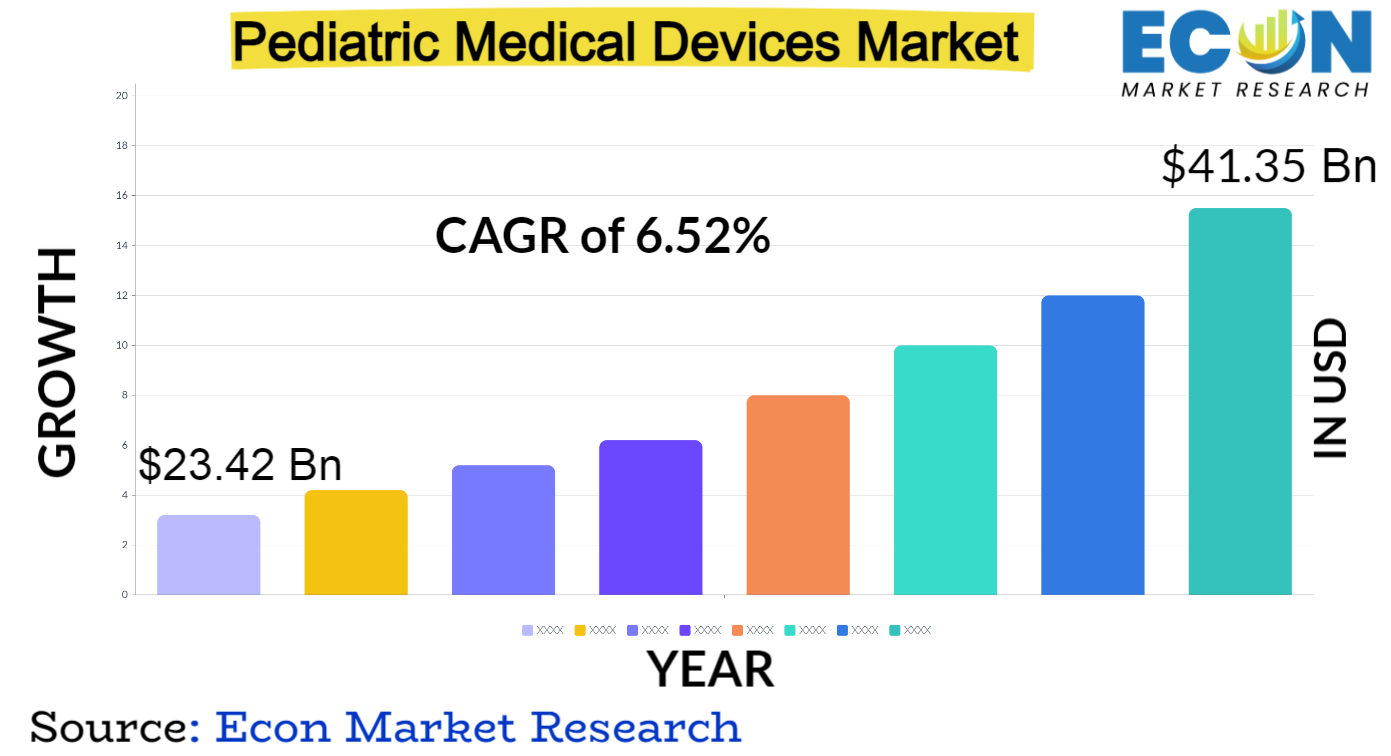

Pediatric Medical Devices Market is predicted to reach approximately USD 41.35 billion by 2031, at a CAGR of 6.52% from 2022 to 2031.

A vast array of medical devices created especially for new-bo s, kids, and teenagers to meet their specific healthcare needs are included in the global market for paediatric medical devices. These tools are essential for the detection, tracking, and management of a wide range of paediatric ailments, from chronic illnesses to congenital defects. Children',s unique anatomical and physiological features are catered for in paediatric medical devices, which include therapeutic, diagnostic, and assistive technologies. By prioritising safety, effectiveness, and age-appropriate design, these devices have a substantial positive impact on paediatric healthcare outcomes worldwide.

Global Pediatric Medical Devices Report Scope and Segmentation

| Report Attribute | Details |

| Estimated Market Value (2022) | USD 23.42 billion |

| Projected Market Value (2031) | USD 41.35 billion |

| Base Year | 2022 |

| Forecast Years | 2023 &ndash, 2031 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- Based on By Product, by End-user &, Region. |

| Segments Covered | By Product, by End-user &, By Region. |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2031. |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa. |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others. |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Pediatric Medical Devices Dynamics

Growing childhood disease prevalence, growing patient awareness of paediatric health issues, and a growing emphasis on age- and patient-appropriate, personalised healthcare solutions are driving the market. Medical technology advancements, such as novel therapeutic and diagnostic approaches, are critical drivers of market growth. Additionally, encouraging legislative measures and financial incentives targeted at advancing the development of paediatric devices are stimulating industry research and innovation.

However, the market faces several challenges, including regulatory complexities surrounding pediatric clinical trials and the limited financial incentives for companies to invest in pediatric device research and development. Additionally, the need for specialized expertise in designing and manufacturing pediatric medical devices poses a barrier to entry for some companies. Addressing these challenges requires collaborative efforts among industry stakeholders, healthcare providers, and regulatory bodies to streamline regulatory processes, incentivize research, and enhance knowledge sharing.

Pediatric Medical Devices Drivers

- Growing Pediatric Population and Disease Burden

The market for paediatric medical devices is significantly driven by the growing number of children worldwide and the accompanying rise in the prevalence of childhood illnesses. The need for specialised medical devices that address the particular healthcare requirements of newbo s, kids, and teenagers is growing as demographic trends continue to change.

The growing number of people in this demographic and the increased awareness of health problems pertaining to children drive the need for novel diagnostic and treatment approaches. As healthcare providers and device manufacturers work to develop and introduce cutting-edge technologies specifically tailored for paediatric patients, this driver highlights the market',s potential for sustained growth.

- Advancements in Medical Technology

Rapid advancements in medical technology contribute significantly to the growth of the Pediatric Medical Devices market. Innovations such as advanced imaging techniques, minimally invasive procedures, and smart healthcare devices enhance diagnostic accuracy, treatment efficacy, and overall patient outcomes. These technological breakthroughs not only address the unique physiological characteristics of pediatric patients but also improve the overall healthcare experience for both young patients and healthcare providers. The integration of digital health solutions, including remote monitoring and telemedicine, further expands the market',s reach and effectiveness. The continuous evolution of medical technology remains a key driver, fostering a conducive environment for the development and adoption of cutting-edge pediatric medical devices.

Restraints:

- Regulatory Challenges and Complexities

The market for paediatric medical devices is severely constrained by the regulatory obstacles and complications related to paediatric clinical trials and approvals. Innovation and market entry are hindered by strict regulatory requirements for testing and approval of devices intended for children, as well as ethical considerations. Manufacturers face challenges due to the intricate nature of paediatric research, which involves gaining informed consent and taking developmental factors into account. To overcome these regulatory obstacles, industry players and regulatory agencies must work together to create efficient procedures that guarantee the security and effectiveness of paediatric medical devices without unduly impeding innovation.

- Limited Financial Incentives for Pediatric Device Development

One major impediment to the market is the lack of financial incentives for companies to engage in research and development of paediatric devices. Paediatric medical devices typically serve smaller patient populations than adult-focused medical devices, which makes them less profitable for manufacturers. Some companies might be deterred from actively pursuing innovation in the paediatric device space due to the longer development timelines and lower economic viability of these devices. In order to overcome this constraint, policies and incentives that promote and incentivize investment in the development of paediatric medical devices must be put in place. This will create a more advantageous economic climate for businesses looking to conduct research and introduce novel solutions to the market.

Opportunities:

- Rising Focus on Telehealth and Remote Monitoring

The market for paediatric medical devices has a significant opportunity due to the growing use of telehealth and remote monitoring. The global trend towards digital health solutions, particularly in the aftermath of the COVID-19 pandemic, creates opportunities for the integration of remote monitoring devices and pediatric-focused telehealth platforms. These innovations improve paediatric patients', access to healthcare and provide real-time data for tracking and treating chronic illnesses. By creating and promoting products that easily connect with telehealth platforms, the market can take advantage of this chance to offer paediatric care that is comprehensive while addressing accessibility and distance issues.

Segment Overview

- By Product

The pediatric medical devices market encompasses a diverse range of products designed to address the unique healthcare needs of infants, children, and adolescents. Cardiology Devices form a critical segment, including specialized equipment for pediatric cardiac diagnostics and interventions. In Vitro Diagnostic (IVD) Devices play a pivotal role in pediatric healthcare by facilitating accurate laboratory diagnostics for various conditions. Diagnostic Imaging Devices, tailored for pediatric anatomical dimensions, enable non-invasive visualization, aiding in the diagnosis and monitoring of diverse medical conditions.

Anesthesia &, Respiratory Care Devices designed specifically for pediatric patients ensure safe and effective administration of anesthesia and respiratory support. The Neonatal ICU Devices segment caters to the delicate needs of newbo s, offering specialized equipment for neonatal intensive care units. The ",Others", category encompasses a spectrum of pediatric medical devices beyond the aforementioned, contributing to the comprehensive and evolving landscape of pediatric healthcare solutions.

- By End-user

The pediatric medical devices market serves a variety of healthcare settings, each playing a crucial role in delivering specialized care to pediatric patients. Hospitals stand as the primary end-user, equipped with comprehensive facilities to address a wide range of pediatric medical needs, from routine check-ups to complex surgical interventions. Pediatric Clinics focus specifically on child and adolescent healthcare, providing a specialized environment for diagnosis, treatment, and preventive care. Ambulatory Surgical Centers offer a more streamlined and outpatient-focused approach, catering to pediatric surgical procedures that do not require extended hospital stays.

The ",Others", category encompasses diverse end-users contributing to pediatric healthcare, such as home healthcare settings, educational institutions, and community health centers. The segmentation by end-user reflects the varied healthcare landscapes where pediatric medical devices are utilized, highlighting the adaptability and broad applicability of these devices across different settings. Together, these end-user segments create a network of care that ensures accessibility and specialized attention for pediatric patients, aligning with the goal of enhancing overall healthcare outcomes for the younger population.

Pediatric Medical Devices Overview by Region

North America, a prominent market player, is driven by advanced healthcare systems, robust research and development activities, and a high prevalence of pediatric diseases. Europe follows closely, with a focus on stringent regulatory standards ensuring the safety and efficacy of pediatric medical devices. The Asia-Pacific region is witnessing substantial growth, attributed to increasing healthcare investments, rising awareness, and a burgeoning pediatric population. Emerging economies in this region, such as China and India, are becoming pivotal hubs for market expansion, driven by improving healthcare access and a growing middle class.

In Latin America, market dynamics are influenced by evolving healthcare policies and an emphasis on pediatric healthcare infrastructure development. The Middle East and Africa exhibit a mixed landscape, with some regions witnessing a surge in healthcare investments and others facing challenges related to economic constraints and healthcare accessibility. The global market is characterized by collaborative efforts between developed and emerging regions, fostering knowledge exchange and technology transfer to address the diverse healthcare needs of pediatric populations worldwide. Regulatory harmonization initiatives, such as the European Union',s pediatric regulation and regional partnerships in Asia-Pacific, are contributing to a more streamlined approach for pediatric medical device development and market access.

Pediatric Medical Devices Market Competitive Landscape

Key market players include multinational corporations such as Medtronic plc, Johnson &, Johnson, and Philips Healthcare, leveraging their extensive resources for research and development, global distribution networks, and strategic acquisitions to maintain a significant market share. These companies offer a wide range of pediatric medical devices, spanning diagnostic tools, therapeutic equipment, and advanced technologies.

Emerging players, often characterized by a focus on niche pediatric healthcare segments, contribute to the competitive dynamics by introducing innovative solutions and challenging established norms. Start-ups and smaller enterprises, such as PediaSure, are gaining traction with specialized products and technologies targeting specific pediatric health conce s. Collaboration and partnerships between industry players and healthcare institutions are becoming increasingly prevalent, fostering knowledge sharing and the development of comprehensive pediatric healthcare solutions.

Persistent efforts to address regulatory obstacles and foster innovation in paediatric devices impact the competitive landscape. The goal of initiatives like the Paediatric Device Consortia (PDC) in the US is to speed up the development and approval of paediatric medical devices by facilitating cooperation between industry, academia, and regulatory agencies. The competitive dynamics are further enhanced by strategic alliances between businesses, academic institutions, and healthcare organisations. These alliances allow for the development of synergies that spur innovation and market expansion.

Key Players:

,

-

Abbott

-

Medtronic PLC

-

Boston Scientific Corporation

-

GE Healthcare

-

Johnson &, Johnson

-

Philips Healthcare

-

Stryker Corporation

-

Cardinal Health, Inc.

-

F. Hoffmann-La Roche Ltd.

-

Siemens Healthineers

-

Hamilton Medical

-

Ningbo David Medical Device Co. Ltd.

-

TSE Medical

-

Fritz Stephan GmbH

Pediatric Medical Devices Recent Developments

- September 2023, the National Institutes of Health (NIH) has initiated the design phase for a collaborative effort aimed at addressing the shortage of medical devices specifically tailored and approved for children in the United States. During this initial stage, the NIH and its collaborators will formulate a comprehensive plan to establish a partnership that integrates the capabilities of U.S. gove ment entities and private sector stakeholders, encompassing both industry and non-profit organizations.

- Oct 2023, OrthoPediatrics Corp., a dedicated player in the pediatric orthopedics domain, has revealed a strategic collaboration with Children&rsquo,s National Hospital in Washington, DC, operating within the framework of the ",Alliance for Pediatric Device Innovation", (APDI). This partnership aims to provide guidance for the development and commercialization of medical devices specifically tailored for pediatric use.

Global Pediatric Medical Devices report segmentation

| ATTRIBUTE | , , , , ,DETAILS |

| By Product |

|

| By End-user |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

No FAQs available.

Report Details

- Published Date:Jan 8, 2024

- Format:PDF

- Language:English

- Delivery:Instant

Download Sample

Get a free sample report to preview the content and quality.