Water Treatment Chemicals Market Research Report: By Type (Flocculants and Coagulants, Biocides and Disinfectants, Defoamers and Defoaming Agents, pH Adjusters and Softeners and Corrosion Inhibitors), By Category (Boiling Water Treatment, and Cooling Water Treatment), By End-User (Electric Power Generation, Oil and Gas, Chemicals Manufacturing, Mining and Minerals Processing, Municipal, Food and Beverages, and Pulp and Paper), and Region (North America, Europe, Asia-Pacific, and Rest of the World) Global Industry Analysis, Size, Share, Growth, Trends, Regional Analysis, Competitor Analysis and Forecast 2023-2031.

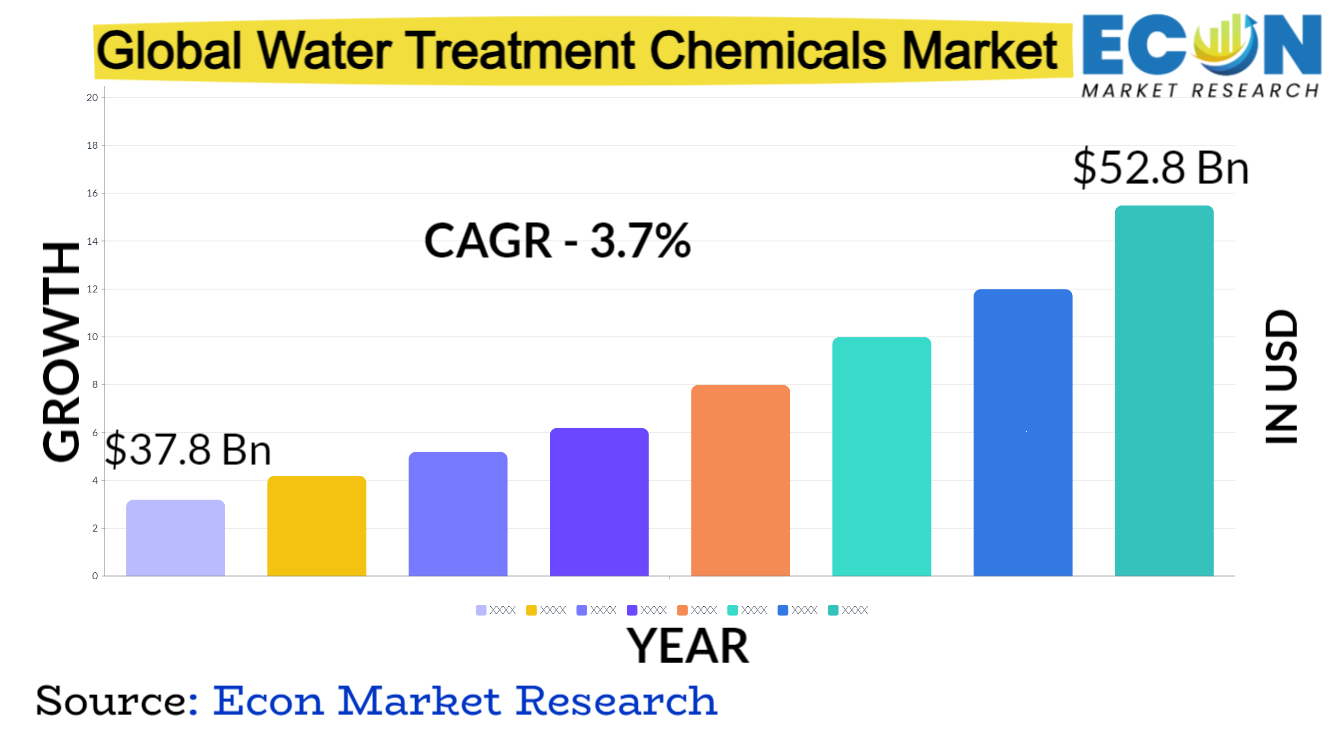

The Water Treatment Chemicals Market was valued at USD 37.8 billion in 2022 and is estimated to reach approximately USD 52.8 billion by 2031, at a CAGR of 3.7% from 2023 to 2031.

The market for chemicals used in water treatment is an essential industry that aims to improve and purify water for use in municipal and industrial settings. It includes a broad range of substances and methods intended to purify water by getting rid of pollutants, germs, and impurities. These substances are essential to maintaining the sustainability of the environment, industrial operations, and drinking water safety. The industry has experienced significant expansion as a result of growing worldwide apprehensions about water scarcity, declining water quality, and strict restrictions conce ing wastewater disposal.

Coagulants, flocculants, pH adjusters, corrosion inhibitors, disinfectants, and others are important market categories. Each of these products has a distinct function in the water treatment process. , This market is continuing to rise because to the increasing need for clean, drinkable water as well as the speed at which industries and cities are industrializing and urbanizing. Businesses in this industry constantly innovate to create affordable, environmentally friendly solutions to the changing problems related to water treatment, which greatly aids in the global market',s growth and sustainability initiatives.

| Report Attribute | Details |

| Estimated Market Value (2022) | 37.8 Bn |

| Projected Market Value (2031) | 52.8 Bn |

| Base Year | 2022 |

| Forecast Years | 2023 - 2031 |

| Scope of the Report | Historical and Forecast Trends, Industry Drivers and Constraints, Historical and Forecast Market Analysis by Segment- By Type, By Category, By End-User, &, Region |

| Segments Covered | By Type, By Category, By End-User, &, Region |

| Forecast Units | Value (USD Billion or Million), and Volume (Units) |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2023 to 2031 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East &, Africa, and the Rest of World |

| Countries Covered | U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, GCC Countries, and South Africa, among others |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter&rsquo,s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

| Delivery Format | Delivered as an attached PDF and Excel through email, according to the purchase option. |

Water Treatment Chemicals Market Dynamics

Growing urbanization, industrialization, and population growth around the world increase the need for clean water, which fuels market expansion. Industries are compelled to implement effective water treatment systems due to regulatory frameworks and environmental conce s that require strict standards. The creation of novel chemicals and techniques that improve treatment efficacy and sustainability is facilitated by technological improvements. Furthermore, regional differences in water quality influence market dynamics and need for customized solutions for various geographic locations.

Variations in the economy have an effect on the infrastructure investment in water treatment, which in tu affects market trends and chemical demand. Greener alte atives are developed as a result of the transition to sustainable and eco-friendly activities, which encourages competition among market participants. Furthermore, market environments are changed by industry players', mergers, acquisitions, and partnerships, which has an impact on product offers and market penetration. Campaigns to raise consumer awareness and provide education on water treatment and conservation have a further effect on consumer behavior and market dynamics.

The dynamics of the water treatment chemicals market are complex and influenced by a variety of factors, including consumer behavior, industrial partnerships, technological advancements, regulatory regulations, and environmental conce s. It is imperative that stakeholders comprehend these characteristics in order to effectively navigate and seize emerging possibilities within this dynamic market.

Water Treatment Chemicals Market Drivers

- Increasing Water Contamination Conce s

The market for chemicals used in water treatment is being driven primarily by growing worries about water contamination. Public knowledge and conce about water quality have increased as a result of growing evidence of pollutants, industrial waste, agricultural runoff, and new toxins into water sources. These conce s are heightened by incidents of chemical spills, inappropriate waste disposal, and pollution brought on by urbanization. The need for efficient water treatment solutions is growing as communities become more aware of the negative effects that contaminated water sources have on the environment and public health. These worries go beyond personal use, gove ments in charge of public water supply and businesses that depend on water for production must pay closer attention to guarantee water safety.

As a result, the use of sophisticated chemicals for water treatment becomes essential in order to eliminate various infections, pollutants, and toxins. This driver not only stimulates market expansion but also emphasizes how important these chemicals are to maintaining ecosystems, protecting public health, and providing essential water supplies for present and future generations.

- Growing Industrialization and Urbanization

As metropolitan areas expand and industry burgeon, the burden on water resources amplifies. Mining, industry, and energy generation are among the industries that depend on large volumes of water for their operations. At the same time, population density increases in metropolitan areas lead to higher household water use and trash production. As a result, wastewater flow from both industrial and municipal sources rises and contains a wide range of toxins and pollutants. Strong water treatment becomes essential to remedy this.

Mode water treatment chemicals are required by the expanding urban and industrial sectors in order to effectively recycle, cleanse, and reuse water. This force propels advancements in treatment techniques and the creation of specialized compounds to counteract a variety of contaminants resulting from urban activities and industrial processes. Consequently, the market for water treatment chemicals grows rapidly, providing customized solutions to businesses and gove ments looking to meet legal requirements, improve sustainability, and guarantee clean water availability in the face of growing demands and environmental stresses.

Restraints:

- Limited Access to Clean Water Technologies

This limitation is more common in some areas, particularly in developing countries or isolated places, and it is caused by a number of circumstances. The application of state-of-the-art water treatment technology is impeded by inadequate infrastructure and financial constraints, which limits access to advanced purification techniques. Furthermore, this restriction is made worse by a lack of technical know-how and trained staff, which makes it more difficult to maintain and operate cutting-edge treatment equipment.

Economic inequality makes matters worse by making it difficult for underprivileged populations to acquire or obtain these technologies, which keeps them dependent on antiquated and frequently ineffective conventional water treatment techniques. This restriction disproportionately affects vulnerable populations by dividing access to clean and secure water resources. Gove ments, non-gove mental organizations, and the commercial sector must work together to address this issue by making infrastructural investments, facilitating technology transfer, offering training, and creating affordable solutions that are suited to the particular requirements of these neglected areas. By removing this barrier, we can reduce the incidence of waterbo e illnesses and close the gap in global water accessibility, which will promote equitable and sustainable development. ,

- Health and Safety Conce s

Even though they are useful in cleaning water, several chemicals used in water treatment procedures can be harmful to your health if handled carelessly or applied incorrectly. For example, improperly dosed disinfectants or coagulants can leave behind hazardous residues that could be consumed and have an impact on public health. Furthermore, workers who handle or apply particular chemicals may be exposed to health risks over an extended period of time. In addition to gove mental scrutiny and public fear, conce s regarding potential toxicity, carcinogenicity, or negative effects on aquatic life are also present.

Due to increased scrutiny, chemical manufacturers and users must follow strict safety procedures and take appropriate handling, storage, and disposal measures, which raises operational costs and complicates operations. , Moreover, an extra degree of complication is introduced by the requirement to continuously monitor and follow safety rules and standards, which discourages certain businesses from using sophisticated but possibly safer chemical alte atives. In order to reduce hazards and guarantee the safe and responsible use of chemicals used in water treatment, these conce s call for ongoing research, strict safety procedures, and regulatory compliance measures that address both environmental and human health safety issues.

Opportunities:

- Emerging Technologies and Innovations

Transformative water treatment solutions are made possible by ongoing technological innovation and developments including membrane filtration, nanotechnology, and smart monitoring systems. For example, nanotechnology presents the possibility of extremely effective filtering systems that can eliminate minute impurities, opening the door to safer and cleaner water. Selective pollution removal is made possible by advanced membrane technologies, offering more focused and efficient treatment options.

Furthermore, real-time insights into water quality are provided by smart monitoring systems with sensors and data analytics, which improve operational effectiveness and allow for early detection and resolution of possible problems. By using less energy, chemicals, and waste, these advances promote sustainability in addition to increasing the effectiveness of water treatment procedures. They provide manufacturers with chances to create environmentally friendly compounds and solutions that are suited to deal with particular pollutants, thereby satisfying ever-tougher regulatory requirements. These developments also draw funding, which encourages partnerships between producers of chemicals, water treatment services, and developers of technology to produce integrated and all-encompassing solutions.

- Water Reuse and Recycling Initiatives

Reusing and recycling water become essential tactics to relieve pressure on freshwater supplies as the world',s water scarcity worsens. To filter and treat wastewater to levels appropriate for a variety of non-potable purposes, such as agricultural irrigation, industrial activities, and even the generation of potable water, these programs necessitate complex treatment procedures and specific chemicals. To meet strict quality requirements for recycled water, customized chemical solutions and cutting-edge treatment methods are essential. This focus on water reuse minimizes the impact on the environment by relieving pressure on conventional water sources while also addressing conce s about scarcity.

It encourages the creation of novel chemical compositions and treatment strategies that effectively target particular pollutants present in wastewater. Water treatment chemical companies take use of this to develop customized products that are tailored for various reuse applications, helping to shift the paradigm of water management toward one that is more sustainable and circular. In addition, these endeavors correspond with regulatory inducements and promote cooperation among industries, technology developers, and treatment specialists, cultivating a cooperative ecosystem aimed at accomplishing worldwide water sustainability objectives.

Segment Overview

- By Type

Based on type, the global water treatment chemicals market is divided into flocculants and coagulants, biocides and disinfectants, defoamers and defoaming agents, pH adjusters and softeners and corrosion inhibitors. The flocculants and coagulants category dominates the market with the largest revenue share in 2022. These chemicals assist in the aggregation and precipitation of suspended particles in water. Coagulants destabilize particles, while flocculants help bind the destabilized particles together, forming larger clumps that can be easily removed through filtration.

Biocides and disinfectants are crucial for eliminating microorganisms, bacteria, and pathogens present in water. They sanitize water by killing or inhibiting the growth of harmful microbes, ensuring its safety for consumption or various industrial uses. Defoamers and defoaming agents, these chemicals help control or eliminate foam formation in water treatment processes. Foaming can hinder the efficiency of treatment systems, and defoamers work to suppress foam formation, aiding in smooth and effective water treatment. pH adjusters regulate the acidity or alkalinity of water to achieve optimal pH levels for specific treatment processes. Softeners primarily target hard water by removing excess minerals like calcium and magnesium, preventing scale buildup in pipes and equipment. Corrosion inhibitors prevent or minimize the degradation of metal surfaces in water systems. They form a protective layer on metal surfaces, preventing corrosion caused by the interaction between water and metal components.

- By Category

Based on the category, the global water treatment chemicals market is categorized into boiling water treatment, and cooling water treatment. The boiling water treatment category leads the global water treatment chemicals market with the largest revenue share in 2022. This category focuses on treating water primarily used in boilers for steam generation. In boiler systems, water is heated to produce steam, which is often used for power generation, heating, or industrial processes. Boiling water treatment involves the use of specific chemicals to prevent scale formation, corrosion, and fouling inside the boiler. These chemicals include corrosion inhibitors to protect metal surfaces, scale inhibitors to prevent mineral deposits, and oxygen scavengers to eliminate dissolved oxygen, which can cause corrosion.

Cooling water treatment, on the other hand, is aimed at managing water quality in cooling systems such as those used in industrial processes, air conditioning, or power generation. Cooling systems remove heat by circulating water through heat exchangers or condensers. These systems are prone to issues like scale formation, corrosion, and biological fouling. Chemicals used in cooling water treatment include corrosion inhibitors, scale inhibitors, biocides to control microbial growth, and dispersants to prevent particles from forming deposits.

- By End-User

Based on end-user, the global water treatment chemicals market is segmented into electric power generation, oil and gas, chemicals manufacturing, mining and minerals processing, municipal, food and beverages, and pulp and paper. The municipal segment dominates the water treatment chemicals market. Municipal water treatment involves supplying clean drinking water and treating wastewater before discharge. Chemicals are used for disinfection, coagulation, pH adjustment, and removing contaminants to ensure safe drinking water and environmentally friendly wastewater disposal.

Power plants, especially those reliant on steam turbines, use vast amounts of water for cooling and steam generation. Water treatment chemicals are crucial here to prevent scale formation, corrosion, and biological fouling in boilers, cooling towers, and other equipment. In the oil and gas industry, water is utilized extensively for drilling, hydraulic fracturing, and refining processes. Water treatment chemicals are employed to treat produced water, control corrosion in pipelines and equipment, and manage wastewater generated during extraction and refining operations. Chemical production involves various processes that require water for reactions, cooling, and cleaning. Water treatment chemicals help control impurities, maintain process efficiency, and prevent corrosion in equipment used in chemical manufacturing.

The mining industry utilizes water for extraction, transportation, and processing of minerals. Water treatment chemicals aid in managing water quality, preventing scale and corrosion in equipment, and treating wastewater generated from mining operations. Water is a crucial component in food and beverage production, used for cleaning, processing, and as an ingredient. Water treatment chemicals assist in maintaining hygiene, controlling microbial growth, and ensuring water quality compliance in this sector. , In the pulp and paper industry, water is used extensively in various stages of production. Water treatment chemicals aid in removing impurities, controlling scale formation, and managing effluents generated during paper manufacturing processes.

Water Treatment Chemicals Market Overview by Region

The global water treatment chemicals market is categorized into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific emerged as the leading region, capturing the largest market share in 2022. The need for clean water has expanded dramatically across a range of applications due to rapid industrialization, urbanization, and population growth in countries like China, India, Japan, and Southeast Asian nations. This increased demand affects a number of businesses, including industry, oil and gas, electricity generation, and municipal water treatment. In addition, the region',s adoption of cutting-edge water treatment technologies has been prompted by strict gove ment laws focused on environmental preservation and water purity.

Industries have made large investments in chemicals and water treatment technology to ensure effective and environmentally sound water management practices due to the necessity of adhering to these requirements. In addition, the Asia-Pacific region',s high concentration of water-intensive businesses and rising consciousness of water scarcity conce s have accelerated the adoption of chemicals for water treatment. Businesses in this area are constantly coming up with new and creative ways to solve the growing need for clean water at a reasonable cost. Furthermore, the Asia-Pacific water treatment chemicals market has grown as a result of the growing emphasis on sustainable practices and the adoption of eco-friendly treatment technologies in response to environmental conce s.

Water Treatment Chemicals Market Competitive Landscape

In the global water treatment chemicals market, a few major players exert significant market dominance and have established a strong regional presence. These leading companies remain committed to continuous research and development endeavors and actively engage in strategic growth initiatives, including product development, launches, joint ventures, and partnerships. By pursuing these strategies, these companies aim to strengthen their market position, expand their customer base, and capture a substantial share of the market.

Some of the prominent players in the global water treatment chemicals market include Ecolab, Kemira, Danaher, BASF SE, Kurita Water Industries Ltd, GENERAL ELECTRIC, BWA Water Additives, Cortec Corporation, DOW, Buckman, Solvay, Akzo Nobel N.V, Air Products and Chemicals, Inc, ION EXCHANGE, Carus Group In, Thermax Limited, Hydrite Chemical Co, and various other key players.

Water Treatment Chemicals Market Recent Developments

- In January 2023, Kemira, a supplier of chemical solutions to water-intensive sectors, has successfully acquired SimAnalytics in its entirety. Kemira is now better equipped to serve its customers', companies with data-driven predictive services and machine lea ing solutions thanks to this calculated strategic move.

Water Treatment Chemicals Market Report Segmentation

| ATTRIBUTE | , , , , ,DETAILS |

| By Type |

|

| By Category |

|

| By End-User |

|

| By Geography |

|

| Customization Scope |

|

| Pricing |

|

,

No FAQs available.

Report Details

- Published Date:Dec 6, 2023

- Format:PDF

- Language:English

- Delivery:Instant

Download Sample

Get a free sample report to preview the content and quality.